Posted on: April 26, 2023, 03:28h.

Last updated on: April 26, 2023, 03:29h.

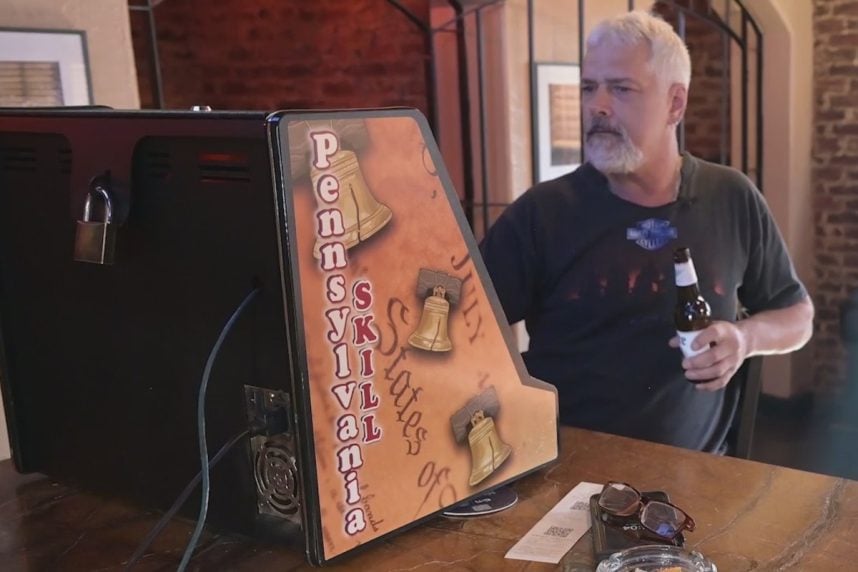

Pennsylvania skill gaming machines continue to operate across the commonwealth in a grey legal area.

Proponents of the controversial devices rallied outside the Pennsylvania State Capitol this week to hype the benefits that the machines provide to small businesses. In what’s a political rarity, the industry is seeking to become regulated and taxed through state legislation.

Currently, skill gaming machines, which are commonly found inside restaurants and bars, gas stations, supermarkets, and retail strip malls, are not taxed nor regulated. Revenue from the terminals is shared between the gaming manufacturer, route distributor, and host business.

The legality of skill gaming remains tied up in the state court system. Last month, an appeal was filed on behalf of six casinos in Pennsylvania — Parx, Mohegan Pennsylvania, Hollywood Casino at Penn National, Hollywood Casino at The Meadows, Harrah’s Philadelphia, and Wind Creek Bethlehem. The petition contests a 2019 ruling from Commonwealth Court Judge Patricia McCullough.

In that opinion, McCullough said skill gaming machines are not governed by the Pennsylvania Gaming Act, as the law only regulates games of chance. Her ruling also concluded that the Pennsylvania State Police has no legal authority to seize skill gaming machines.

Skill games allow a player to alter the outcome of a spin and determine if the bet wins or loses. The primary difference between a skill gaming machine and a traditional slot machine found inside one of Pennsylvania’s 17 brick-and-mortar casinos is that a skill player must identify a winning payline. Conversely, a slot machine automatically tells a gambler if their spin won or lost.

The casinos are appealing McCullough’s ruling to the Pennsylvania Supreme Court. Representatives of the legal casino industry additionally claim that skill gaming machines hurt their own business operations and the Pennsylvania Lottery.

Small Business Lifeline

Pennsylvania skill gaming advocates gathered yesterday in Harrisburg to get out their claimed message that their machines do a bunch of good for small businesses. Though the machines are not governed and therefore do not need to adhere to payout minimums as casino slots do, the industry says the revenue has been a lifeline for many local eateries, stores, and organizations.

These games are important to businesses across Pennsylvania, and not only to businesses, but to veteran organizations, volunteer fire companies, and fraternal groups,” said former Penn State football great LaVar Arrington, who has become a spokesperson for the skill gaming industry.

Arrington was tapped last year by Virginia-based Pace-O-Matic, the gaming manufacturing firm behind the popular “Pennsylvania Skill” gaming cabinets, to help get out the company’s message about the supposed good that skill gaming is doing in the commonwealth.

“Some veterans groups are only able to keep their doors open because of the supplemental revenue that they receive from skill games,” Arrington continued. “It’s sad to think that if they’re not able to have those revenue streams, those doors would close.”

Proposed Legislation

The small crowd of Pennsylvania skill gaming backers expressed their support of forthcoming legislation that would formally legalize the machines and cement their status in the Keystone State.

State Sen. Gene Yaw (R-Williamsport) is finalizing skill gaming legislation that he plans to introduce in Harrisburg in the coming weeks. Yaw says the bill will seek to provide consumer protections and generate tax revenue from the machines.

“There is significant tax revenue to be gained from skill games,” Yaw declared on Tuesday.

State law enforcement estimates that there are 70,000 skill gaming machines in operation in Pennsylvania. Yaw says placing a tax on the machines’ revenue could generate upwards of $300 million annually for the state.

The skill gaming industry, however, is urging Yaw to not endorse an excessive tax that would take money away from the local businesses that house the devices. Casinos say if the skill interests want to play, they need to pay just like their companies did.

Most of Pennsylvania’s casinos paid $50 million each in licensing fees to the state. The casinos are additionally required to share more than 50% of their slot win with the state.