Published on: October 7, 2024, 11:15h.

Updated on: October 7, 2024, 11:15h.

Following an audit that uncovered over $1 billion in uncollected income tax on recent casino winnings, the IRS is taking action to address the issue. One prominent Las Vegas casino gambler is now facing scrutiny as part of this crackdown.

This information was revealed in a report dated September 30 from the Treasury Inspector General for Tax Administration (TIGTA), an independent IRS oversight group. The report identified 148,908 individuals with gambling winnings exceeding $15,000 who failed to file tax returns between 2018 and 2020.

The total amount of winnings for these individuals surpassed $13.2 billion, resulting in unpaid taxes of over $1.4 billion.

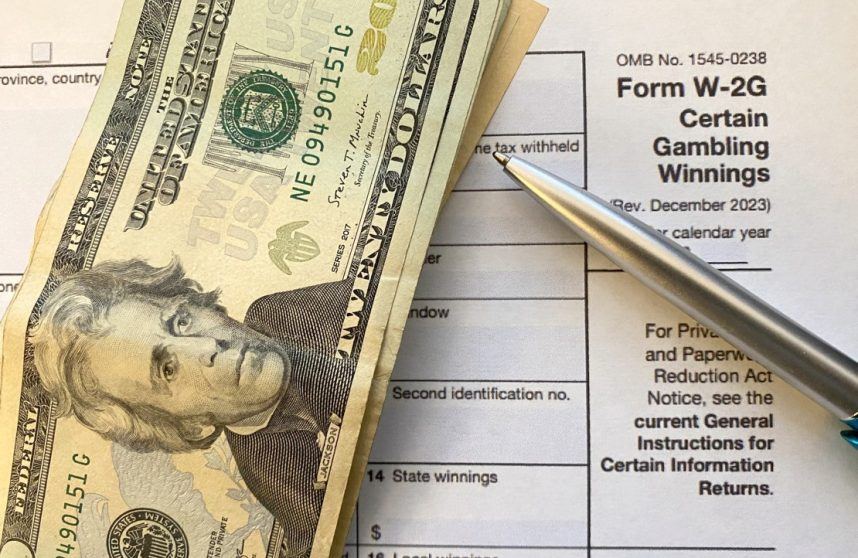

TIGTA’s analysis focused on W-2G forms issued by casinos for slot jackpots of $1,200 or more and Keno wins of $1,500 or more. The report highlighted that 103,000 of these winners had not been notified or faced enforcement actions to ensure tax compliance.

In response to the report, the IRS stated, “We agree with the recommendation” and committed to enforcing actions against non-compliant individuals.

Other Discoveries

Aside from the tax evasion issue, the TIGTA report also raised concerns about casinos submitting W-2Gs without taxpayer identification numbers. This lack of identification complicates the IRS’s efforts to track and collect taxes from recipients.

Furthermore, TIGTA noted the insufficient processes in place at the IRS to monitor compliance with excise taxes by gambling operators, especially in the rapidly expanding online sports betting sector.

The IRS concurred with the recommendation regarding excise tax noncompliance but downplayed the significance of W-2Gs without taxpayer IDs due to their relatively small number.

TIGTA responded, “While the population affected may be small, the amount of backup withholding that should have been taken is substantial.”

Critical Error

Recently, Scott Roeben, creator of Casino.org‘s Vital Vegas blog, received an IRS audit notice regarding $100,000 in unreported W-2G income from 2020. The IRS requested specific documentation from four years ago within 30 days, or further actions would be taken.

Roeven claims that he correctly reported all his gambling income on his 2020 tax return and submitted it on time.

“I followed all procedures accurately,” he stated. “I just had a high number of jackpots, which triggered the audit, presumably.”

Roeben criticized the IRS’s approach as “targeted persecution of casino patrons due to the stigma associated with gambling,” highlighting the lack of understanding within the IRS regarding gambling activities.

He expressed concerns about the burden placed on individuals to navigate audits, seek professional tax help, and reconsider their enjoyment of gambling. Even for those evading taxes, Roeben emphasized that jackpots are only a part of the gambling experience.

He likened the situation to “saying passengers on the Titanic had a fantastic time for 2,070 miles.”