Date: October 25, 2024, 04:20h.

Last updated on: October 25, 2024, 04:20h.

Boyd Gaming’s (NYSE: BYD) shares surged on Friday following the release of their third-quarter results, showcasing growth opportunities in Las Vegas and Norfolk, Virginia.

The stock closed 7.85% higher on significantly increased volume, reaching a new 52-week high. This surge followed bullish comments from the company regarding the Cadence Crossing Casino in suburban Las Vegas and a partnership with a Native American tribe to operate a new gaming venue in Norfolk. Analysts also responded positively, with Stifel analyst Steven Wieczynski raising his price target on Boyd stock to $74 from $67.

BYD is slowly starting to stand out from their industry peers with continuous stable growth in their Las Vegas locals market and a significant long-term growth project in Norfolk, Va.,” stated the analyst.

With these new projects and a strong balance sheet relative to competitors, sentiment towards the stock is expected to improve.

New Casinos Boost Boyd Stock

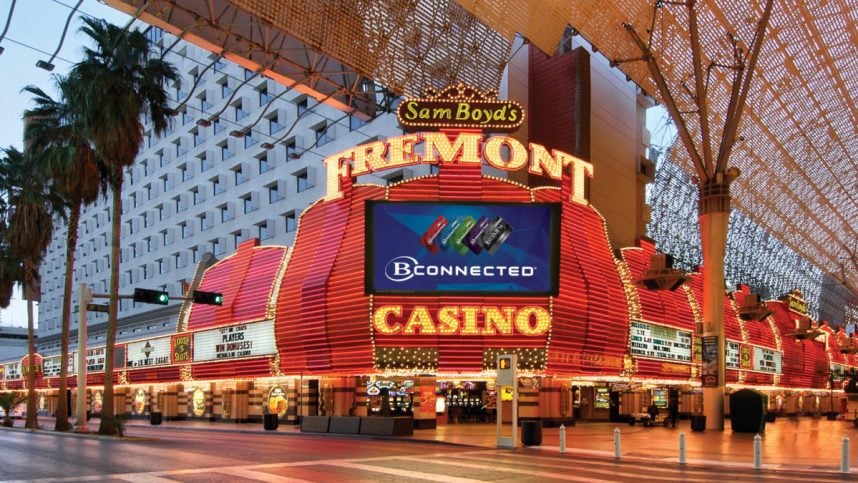

Boyd faces competition from Red Rock Resorts (NASDAQ: RRR) in its core market of Las Vegas, where it aims to maintain a strong presence among local players.

One response to this competition is the development of Cadence Crossing in Henderson, which will replace Jokers Wild Casino. This project reflects Boyd’s commitment to a new master-planned community in the area.

Additionally, the partnership with the Pamunkey Indian Tribe in Virginia for a new gaming venue along the Elizabeth River is seen as a positive move, reducing the need for Boyd to seek out established casino assets.

“The Norfolk project presents a great opportunity for experienced gaming operators to enter a quality market without resorting to large-scale mergers and acquisitions,” added the Stifel analyst. “This $750M venture also decreases the likelihood of BYD acquiring a portfolio of land-based assets, which is reassuring.”

Other Las Vegas Casinos Support Boyd

While Boyd’s downtown Las Vegas segment performed well in the third quarter, the Orleans and the Gold Coast faced challenges due to competitive pressures.

These challenges may come from independent operators offering promotions that compete with Boyd’s properties, as well as Red Rock’s Durango potentially drawing customers away from the Gold Coast and the Orleans.

Boyd recently introduced a new sportsbook at Suncoast, with potential to drive overall activity at that casino hotel, as highlighted by Wieczynski.

“Looking ahead to 2025, Boyd’s position in the regional gaming market could become very compelling. If the company can replicate its success at the Fremont at Suncoast, growth in the Las Vegas locals segment is expected despite tough competition,” concluded the analyst.