Reword all the content from original article, keep HTML tags, make it SEO friendly and unique

Posted on: November 5, 2024, 05:22h.

Last updated on: November 5, 2024, 05:22h.

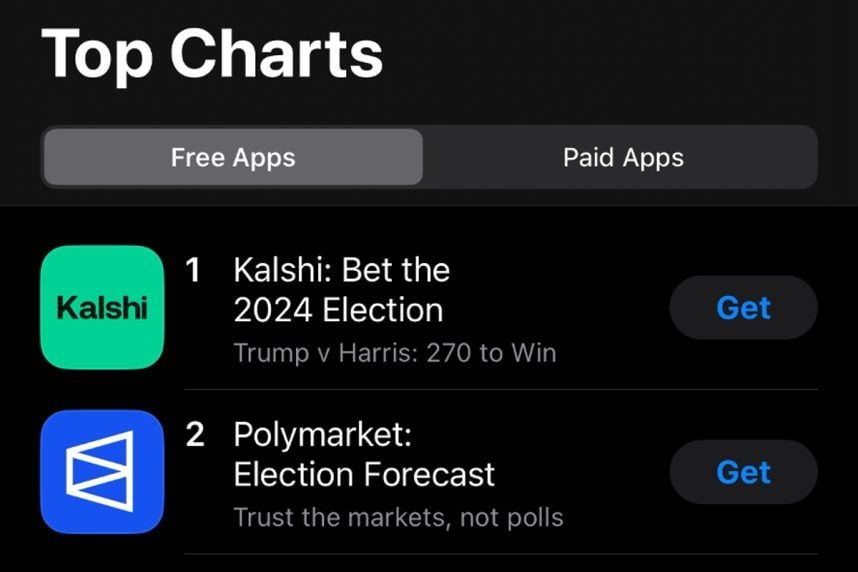

As the first polls close in only a matter of hours, two prominent election betting platforms have hit the top of the Apple App Store chart.

Kalshi and Polymarket have risen to the top of the free apps available for download on the Apple App Store. Apple reports that it currently has nearly two million apps available for download.

Kalshi, which relaunched its 2024 presidential election betting market on Oct. 2 after securing a federal appeals court victory in September, is ranked No. 1 among the Free Apps available on the Apple App Store. Polymarket is No. 2.

The political betting exchanges, which offer event derivatives on a variety of issues ranging from sports to entertainment to business to science, are outranking ChatGPT, the free artificial intelligence app from OpenAI, Facebook’s Threads, McDonald’s, and even Google.

Prediction markets are the future,” said Kalshi cofounder Luana Lopes Lara on X.

Kalshi is presently the only prediction market operating in the U.S. that’s regulated by the Commodity Futures Trading Commission (CFTC).

Election Betting Hysteria

Ever since Donald Trump upset Hilary Clinton in 2016, political betting markets have grown in importance in predicting the outcomes of elections. While betting markets in 2016 also felt Clinton had the likelier path to victory, the odds suggested Trump, the former casino tycoon, had a better shot at an upset than did the polls.

PredictIt was a trailblazer. The online betting exchange received a “No-Action Relief” letter from the CFTC informing the platform that it wouldn’t be subjected to legal recourse for taking bets on U.S. elections, so long as bettors were limited to $850 per contract, or specific election question, and PredictIt’s insights were made available for education and research.

PredictIt never launched an app, however, which led to the website crashing during the 2020 election. In 2022, the CFTC announced its withdrawal of the No-Action Relief and ordered PredictIt to suspend its binary betting contracts.

Meanwhile, Polymarket emerged as a cryptocurrency peer-to-peer prediction platform. The CFTC took regulatory action against the company and settled in early 2022. Polymarket agreed to pay a $1.4 million civil penalty and stop allowing U.S.-based customers to participate.

Despite no bets being allowed on Polymarket from within the U.S., the platform’s 2024 election contract has fielded over $2.8 billion in wagers as of 6 pm EST on Election Day. Kalshi’s 2024 White House outcome has a handle of less than $300 million.

Final Odds

With polls set to soon close, betting markets continue to heavily favor Trump.

On Polymarket, Trump’s shares are trading at the implied price of 61 cents. Harris remains the underdog at 39 cents. On Kalshi, Trump’s stock is going for 58 cents to Harris at 42 cents.

Winning shares are redeemed at $1. Polymarket, being a decentralized blockchain operation, does not charge any fees. However, some intermediaries like Coinbase might charge a transaction fee.

Kalshi charges a $2 per account withdrawal and places trading fees on orders that are immediately executed. The trading fee is complicated at best.

From the Kalshi “Fee Schedule” as filed with the CFTC:

Trading fees are charged as a variable percentage fee of the expected earnings on an individual contract which is calculated by multiplying the maximum potential earnings from the contract by the implied probability of making those earnings – or the price of the contract divided by $1. The current general fee charged for a trade in dollars is given by the following formula: fees = round up(0.07 x C x P x (1-P)) P = the price of a contract in dollars (50 cents is 0.5) C = the number of contracts being traded round up = rounds to the next cent.”

Confused? Us too. However, Kalshi provided an example showing that for a contract trading at 50 cents and a patron purchasing 100 shares, the platform’s fee would amount to just $1.75.