Published on: December 13, 2024, 02:56h.

Last updated on: December 18, 2024, 02:56h.

The unsuccessful All Net Arena venture on the northern end of the Las Vegas Strip was always a financially unsupported failure, as highlighted by Vital Vegas blogger Scott Roeben, the exclusive reporter in the Las Vegas media world, dating back to at least 2017.

However, a lawsuit brought by an investor now alleges that All Net was a more sinister operation — a scheme devised to generate substantial profits for its founder, former UNLV basketball star Jackie Robinson, and his associates and family members for a decade.

Kent Limson and TACSIS APC, the California legal and financial firm where Limson serves as a partner, filed a racketeering lawsuit against Robinson and his company, All Net Land Development LLC, claiming that they collected over $800 million in short-term loans from August 2014 to December 2019 that were never repaid.

The civil lawsuit, lodged in US District Court in Nevada, seeks damages exceeding $6.4 million, which is triple the actual damages incurred by Limson and TACSIS, as stipulated by the RICO Act.

Net Zero

As per the complaint, Robinson, who introduced the project in 2013, personally assured investors repayment through performance bonds from AGS Assurety LLC. Nevertheless, no bonds were ever secured with investor funds. Instead, all the money was funneled into a Las Vegas LLC named Dribble Dunk, controlled by Robinson.

Dribble Dunk, as per the lawsuit, regularly dispensed a portion of the funds to Robinson, his spouse, and associates posing as “consultants.” These individuals allegedly received substantial consulting fees and holiday bonuses.

Another portion of the investment funds supposedly went to AGS Assurety manager Timothy Arellano, who, according to the plaintiffs, never obtained a single bond.

The lawsuit mentions, “Plaintiffs received performance bonds as security for the loans, which plaintiffs would later learn through discovery were fraudulent forgeries.”

According to the lawsuit, the remaining investment funds were used to pay All Net Land Development for the rental or purchase rights to the 26-acre property, formerly home to the Wet n’ Wild waterpark from 1985 to 2004. Additionally, funds were allocated for attorney Torben Welch’s services from Utah-based Messner Reeves.

Limson and TACSIS assert that this scheme operated while Robinson was aware that the All Net project “was facing a significant multimillion-dollar deficit and was on the brink of collapse,” as it lacked the necessary construction loans. The lawsuit names all the individuals and entities associated with All Net who allegedly received investment funds as defendants, along with around 100 others.

A similar lawsuit was filed by Limson and TACSIS in February 2020 in the US District Court of Central California, but it was dismissed on jurisdictional grounds. Many accusations from that case were repeated in the Nevada filing.

After more than a decade of delays, Robinson was compelled to abandon All Net by the Clark County Commission, which unanimously denied another extension of the project’s construction permits in November 2023, realizing that none of the promised funding was ever secured.

Tall Net

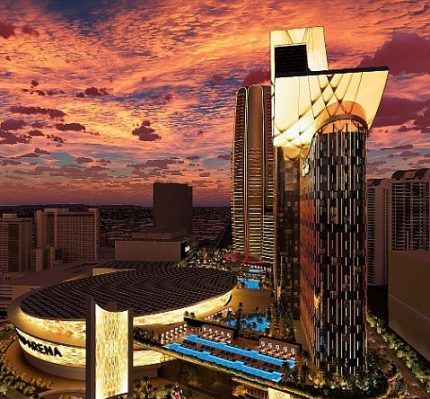

Just four months after the demise of All Net, a different group of developers unveiled plans for a multibillion-dollar resort and NBA arena on the same site. LVXP has declared intentions to commence construction early next year.

This development raises suspicions for Vital Vegas, the only Las Vegas media outlet not simply regurgitating the real estate group’s extravagant announcements and visualizations.

Notably, an NBA arena is already in the works for the Las Vegas Strip. While not officially confirmed, all signs point to it being erected in the current Rio parking lot by the Oak View Group (OVG).

Additionally, LVXP lacks experience in constructing arenas, and its executives include:

- CEO James R. Frazure, a former managing director of an international rare-metal mining group

- Chief of Staff Christine Richards, a professional dancer and choreographer

- Chief Construction Officer Nick Tomasino who, as the Senior VP of Construction for the Sphere, managed to let it go more than a billion dollars over budget.

In contrast, OVG is a reputable company with a history of building sports facilities, such as the Climate Pledge Arena in Seattle, the UBS Arena on Long Island, and Co-Op Live in Manchester, England.

OVG is helmed by Tim Leiweke, the former president of AEG, and Irving Azoff, manager of the rock band called the Eagles.