Published on: August 14, 2025, 02:05h.

Updated on: August 14, 2025, 02:19h.

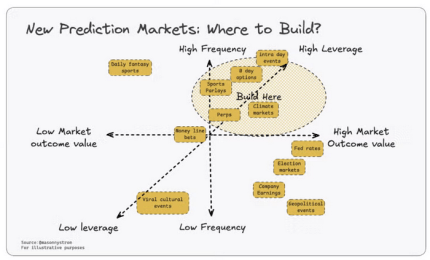

- Sports parlays represent high-frequency, high-leverage opportunities in prediction markets.

- Currently, these companies are not offering such betting options.

- Moneyline wagers are identified as low-leverage with minimal market outcome value.

One element that could escalate the competition between prediction markets and conventional sportsbooks is the integration of sports parlays by the former.

Organizations like Kalshi and Polymarket primarily provide yes/no contracts related to sporting events, similar to moneyline bets, yet they haven’t yet ventured into parlays. However, they may have compelling reasons to explore this betting line.

In a recent report, Pantera Capital, a venture firm focused on cryptocurrency, highlighted sports parlays as a promising growth area for prediction markets, labeling these wagers as “high leverage” opportunities that yield “high market outcome value” while attracting consistent trader engagement.

In contrast, Pantera categorized traditional sports bets as low leverage and low market outcome value. Daily fantasy sports (DFS), which haven’t been frequently regarded as viable for prediction exchanges, rated higher in Pantera’s evaluation compared to moneyline bets, although DFS likely won’t be as profitable as parlays for firms in the prediction market space.

The Importance of Parlays for Prediction Market Success

Parlays have a proven track record of enhancing profits and revenue for traditional sportsbook operators, making it reasonable to predict a similar impact on prediction markets.

“Users seek high leverage or stacked odds to maximize payouts. Parlays, perps, and intraday event markets – these prediction market offerings could significantly boost demand,” explains Mason Nystrom, a junior partner at Pantera.

By introducing parlays, including those within the sports domain, prediction markets can engage the gamification of betting and trading that appeals to younger audiences, all while potentially attaining improved economic performance by fostering a loyal customer base.

“Creating more recurring markets will enhance the economic viability for these platforms, enabling a wider array of market listings and improving customer acquisition efforts, making them more competitive,” added Nystrom. “This phenomenon is already observable in sports betting, where platforms like DraftKings leverage DFS as an effective acquisition and retention method to encourage habitual behavior among users.”

Significance of High-Outcome Value

The interest in US election betting arguably catalyzed the rise of prediction markets in the United States. Some operators, like Polymarket, have excelled in capitalizing on viral trends. Nonetheless, elections are infrequent, and other trending events are often short-lived, leading prediction market operators to focus on expanding offerings that promote high outcome value.

Besides intraday events and climate markets, sports parlays satisfy the criteria for high outcome value. Should Kalshi, Polymarket, and similar companies begin offering parlays, it could herald a new era of adoption for prediction markets, attract regulatory scrutiny, and heighten competition within the gaming sector.

“The resurgence of prediction markets will harness efficient markets to deliver valuable predictive insights and provide a form of leveraged entertainment for customers who trade stocks or engage in sports betting,” concludes Nystrom. “We are on the brink of a significant expansion in the variety of markets and betting opportunities available.”