Published on: September 15, 2025, at 11:05 AM.

Update date: September 15, 2025, at 11:47 AM.

- New research contradicts earlier findings of decreasing consumer credit in online sports betting states.

- Progressive Policy Institute (PPI) reports a slight increase in credit scores in pioneering states.

Legalized online sports betting (OSB) is not linked to a rise in bankruptcy filings or deteriorating credit scores in states where such betting is allowed.

This finding comes from a recent investigation conducted by the Progressive Policy Institute (PPI). Their results identified no signs of a significant increase in bankruptcies or declines in consumer credit quality from 2019 to 2024 in states that were early advocates of OSB. These early adopters, including states like New Jersey, West Virginia, Pennsylvania, Colorado, Illinois, Arizona, and Michigan, legalized internet sports wagering between 2018 and 2021 following the Supreme Court’s decision on the Professional and Amateur Sports Protection Act (PASPA) in 2018.

PPI reports a 40% drop in consumer bankruptcies in early adopter states from 2019 to 2024, contrasting with a 34% decline nationwide and a 36% decrease for all states where mobile sports betting is legalized.

The organization also highlighted that during the same timeframe, average credit scores in these states rose by 1.8%, mirroring the national average increase.

PPI Challenges Previous Research Linking Sports Betting to Economic Hardship

The PPI’s findings oppose existing studies that sought to connect the growth of OSB with heightened personal financial stress.

In 2024, researchers from the University of California, Los Angeles (UCLA), and the University of Southern California (USC) published findings suggesting slight drops in credit scores in OSB states, attributing these declines to rising bankruptcy rates, debt collection issues, debt consolidation loans, and auto loan delinquencies.

The PPI acknowledges that both their study and the UCLA/USC research coincide with periods marked by substantial economic disruptions, including the COVID-19 pandemic and the inflation spike of 2022-2023. They note that interest in sports betting surged during the pandemic when traditional entertainment options were limited, but subsequently decreased as the economy reopened.

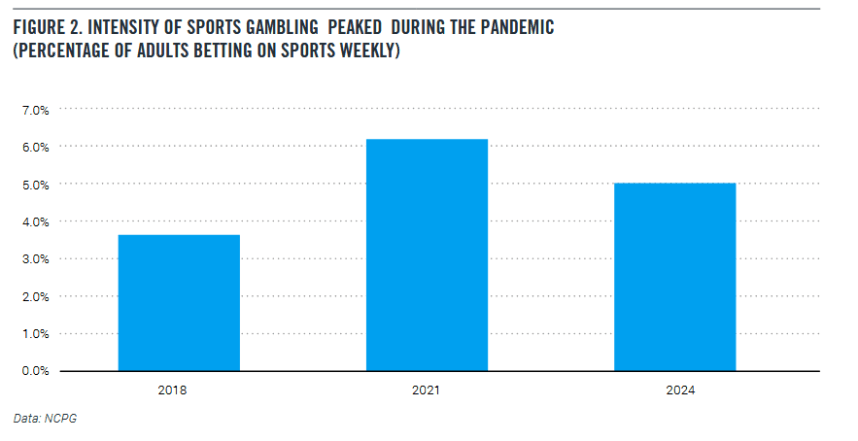

“According to data from the National Council on Problem Gambling (NCPG), the fervor for sports betting peaked during the pandemic and has since reduced,” the PPI reports. “For instance, the percentage of adults participating in weekly sports betting increased from 3.7% in 2018 to 6.2% in 2021. However, the 2024 survey indicated a decrease to 5.0% of adults engaging weekly. Similar trends were noted for other betting frequency patterns.”

PPI Claims Sports Betting Is Not Linked to Increased Bankruptcy Rates

PPI asserts that the expansion of OSB is not correlated with rising bankruptcy levels, a claim that finds some support when considering that gambling, in all its forms, has remained stable as a proportion of overall consumer spending throughout the 21st century.

“We found a 40% reduction in consumer bankruptcies from 2019 to 2024 in early adopting states, compared to a 34% decline nationally,” notes PPI. “For instance, New Jersey and West Virginia, which were among the first to legalize mobile sports betting, experienced bankruptcy declines of 49% and 44% respectively. On the other hand, Alabama, a state that has yet to legalize online sports betting, saw only a 28% decline during the same period.”

In terms of credit scores, the national average increased from 703 in 2019 to 715 in 2024. Across the board, all states—regardless of OSB approval—recorded an average rise in credit scores of 1.7%, which is slightly lower than the national average increase of 1.8%.

While the PPI study claims that sports wagering is not deteriorating credit scores or causing bankruptcy surges, other research suggests that some individuals become so engrossed in betting that they liquidate investment accounts to fund their gambling activities.