Sure! Here’s a reworded and SEO-friendly version of your content while keeping the HTML tags intact:

Published on: September 26, 2025, 09:51h.

Updated on: September 26, 2025, 09:51h.

- Several potential buyers, such as Kalshi and Polymarket, are showing interest in acquiring Novig.

- No confirmation if any official offers have been submitted.

- Novig operates as a peer-to-peer prediction exchange.

Novig, which runs a U.S.-based peer-to-peer sports prediction marketplace, is reportedly attracting interest from various corporate players, including established competitors like Kalshi and Polymarket.

Front Office Sports has reported that “numerous potential buyers,” including Kalshi and Polymarket, have shown interest in acquiring Novig in recent weeks, although it is unclear whether any formal proposals have been made. According to an anonymous source familiar with the dealings, the company is not actively seeking buyers.

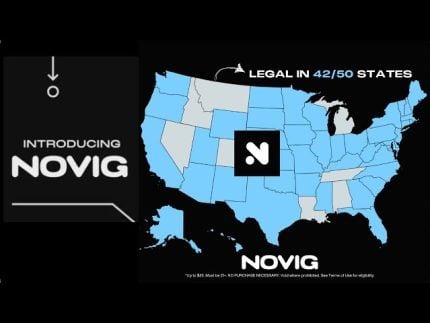

Founded by Jacob Fortinsky and Kelechi Ukah, Novig is accessible in over 40 states, including California and Texas, which do not currently allow traditional sports gambling. Last month, the company disclosed that it secured $18 million in a Series A funding round, spearheaded by Forerunner, with contributions from existing investors like Gaingels, NFX, Perceptive Ventures, and Y Combinator.

Novig’s Appeal in Current Market

If the reports are accurate regarding interest from bidders, it reflects positively on Novig, especially considering it was publicly launched only a year ago.

Therefore, it remains one of the smaller participants in the prediction market sector. Data from Dune Analytics indicates that, as of last week, the leading prediction markets by weekly notional volume comprised Kalshi, Polymarket, Limitless, and Myriad. This quartet is primarily led by Kalshi and Polymarket across various metrics, including open interest, total volume, weekly transactions, and user engagement.

Despite being smaller compared to Kalshi and Polymarket, Novig presents an attractive acquisition option for several reasons, including the growing interest of gaming companies in exploring the event contracts segment. For instance, Flutter Entertainment, the owner of FanDuel (NYSE: FLUT), has already made a significant move in this direction, which has led analysts and investors to speculate on similar actions from rival DraftKings (NASDAQ: DKNG).

Front Office Sports also noted that “additional companies” have shown interest in Novig, though those names were not revealed in the article.

Additional Advantages for Novig

For both gaming operators and prediction market stakeholders, Novig holds extra appeal as all of its contracts are focused exclusively on sports. Unlike Kalshi and Polymarket, Novig avoids offering derivatives based on financial asset prices, economic data, or pop culture activities.

Moreover, Novig’s peer-to-peer structure, where users compete against each other instead of against the company itself, may mitigate some regulatory concerns while fostering a loyal customer base. The company has recently reported that over 90% of the trades facilitated on its platform occur in a peer-to-peer format.

Regarding regulatory matters, sportsbook operators are cautiously navigating the landscape of prediction markets to avoid violating state laws. Recently, Novig discreetly exited New Jersey, a factor that potential buyers from the gaming sector might consider, as those companies wouldn’t want their sports betting licenses compromised in that state.

Feel free to let me know if you need further modifications!

Source link