Published on: December 23, 2025, 11:20h.

Updated on: December 23, 2025, 11:20h.

- Kalshi Research indicates that prediction markets have achieved a 40% lower error rate in inflation forecasting over the last 25 months.

- Kalshi projections demonstrated improved accuracy during significant economic events.

- Notes that inflation estimates from prediction markets can serve as an effective addition to traditional forecasting methods.

Kalshi’s research department recently published findings showing that traders on their prediction market consistently surpass Wall Street analysts in accurately forecasting monthly Consumer Price Index (CPI) readings, a key indicator of consumer prices.

The Kalshi Research study contrasted the CPI forecasts made by Wall Street economists with the projected prices on the Kalshi prediction market from February 2023 to mid-2025. The analysis revealed that Kalshi’s event contracts related to CPI consistently exhibit lower error rates than the consensus estimates from professionals.

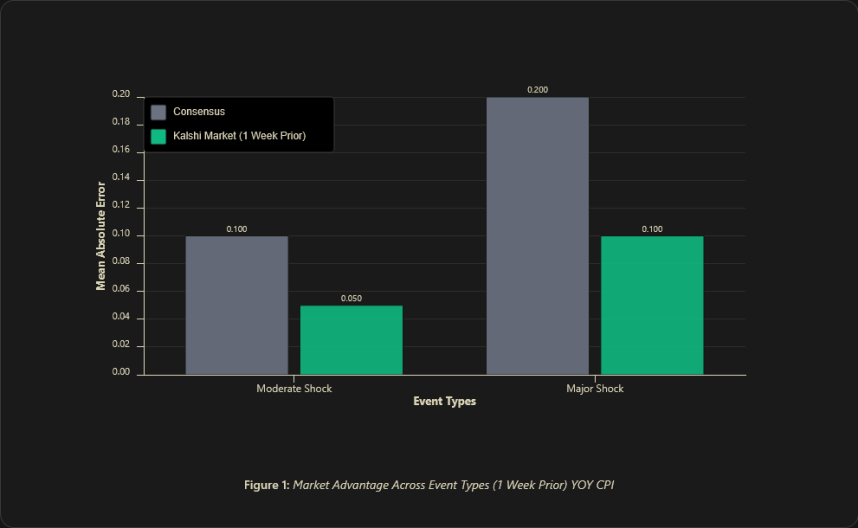

“Our findings show that Kalshi forecasts have a mean absolute error (MAE) that is 40.1% lower than consensus estimates across various conditions, including stable and volatile environments. Notably, we observed a 50% reduction in MAE during significant economic shocks,” stated Kalshi Research.

The research firm noted that during the analysis period, prediction markets outperformed Wall Street CPI forecasts when there was disagreement among market participants, achieving a 75% success rate in those instances.

Optimizing CPI Surprises with Prediction Markets

A key area of excellence for prediction markets is their ability to accurately project CPI surprises, exemplified by the unexpected reading in November, which recorded 2.7%, significantly lower than the anticipated 3% consensus.

While Kalshi acknowledged that the sample size is limited, they emphasized that the collective intelligence of market participants can provide significant insights and enhance traditional economic forecasts relied upon by many in the investment community.

“Moreover, we find initial evidence supporting the capability to predict economic shocks, with deviations from the market consensus showing a positive link with forecast surprises. Our threshold analysis indicates that deviations exceeding 0.1 percentage points can predict a ~81.2% shock occurrence, increasing to ~82.4% just a day prior to the official release,” Kalshi Research observed.

The Importance of Accurate Forecasts

While skeptics may argue that Kalshi is promoting its own findings with a study focused on only one of many key economic indicators monitored by investment professionals, the ability to efficiently manage contracts for events beyond sports is vital for the long-term growth of prediction markets.

Forecasts in prediction markets could potentially increase fivefold by the year 2030. However, achieving or surpassing this goal necessitates greater engagement from professional traders, expanding beyond merely sports-related contracts. The sustainable success of prediction markets relies on broadening their applications, including providing institutional investors with effective hedging strategies.

“For institutional investors, risk management officials, and policymakers, the implications of forecast precision are significantly unequal,” concludes Kalshi Research. “A slight improvement in accuracy during stable periods yields limited value. In contrast, enhanced accuracy during times of market distress—characterized by increased volatility or disrupted relationships—can facilitate substantial alpha generation and minimize losses.”