Published on: January 14, 2026, 10:42h.

Updated on: January 14, 2026, 10:51h.

- A recent analysis indicates that prediction markets do not provide bettors with better opportunities compared to conventional sportsbooks.

- The effective fees for bettors are generally higher on most prediction markets.

- This topic was heavily debated throughout the 2025 NFL season.

As sports event contracts significantly contribute to prediction markets’ transaction volume, scrutiny is increasing regarding their pricing and how yes/no exchanges stack up against standard sportsbooks.

A new study from sports analytics company Bettormetrics highlights that operators of prediction markets have significant challenges ahead if they aim to compete with traditional sports betting in the long run. The research reveals that even a prediction market with “bulletproof liquidity” fails to provide better options for ordinary bettors compared to platforms like DraftKings or FanDuel. Fees contribute to this dilemma.

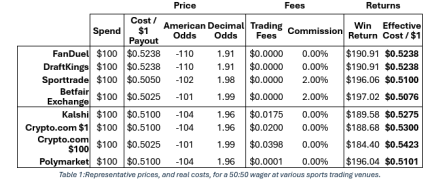

At Kalshi, the fees for any sports event contract utilize an intricate formula calculated as 7% of the number of contracts multiplied by the contract price multiplied by (1 – contract price),” notes Bettormetrics. “In the pick ‘em case, this results in 0.07 x 1 x 0.51 x 0.49 = $0.017493. This must also be rounded up, so the $0.51 contract, which ideally would be $0.50, actually costs between $0.5275 and $0.53, depending on the quantity of contracts bought. Meanwhile, at Crypto.com, the fee is a flat $0.02, again bringing the price to $0.53. Comparatively, at DraftKings, a -110 bet means wagering $110 to potentially earn $210. Essentially, it equates to $0.524 for a $1 return.”

The table shown validates that bettors are not receiving a superior deal from prediction markets compared to what is available at regulated sportsbooks.

Well-Known Pricing Issues in Prediction Markets

It is widely recognized that prediction markets encounter significant pricing issues with sports derivatives. Throughout the 2025 NFL regular season, the industry’s initial venture into sports betting, Kalshi consistently provided poorer pricing compared to both DraftKings and FanDuel.

This trend likely contributes to the fact that these exchanges have captured only 5% of the total handle from regulated sportsbooks, weakening the argument that prediction markets pose a considerable challenge to the established legal sports betting sector. Furthermore, it has become increasingly apparent that casual bettors on these exchanges are primarily preyed upon by skilled betters and market makers, implying that recreational gamblers often incur losses on yes/no exchanges.

Regarding fees, the nascent prediction markets industry still faces issues needing resolution, including a lack of standardization, which means that the fee structures can vary significantly across different exchanges.

“The primary takeaway is that Crypto.com’s flat fee of $0.02 is inherently high across the board. Although Kalshi’s fee structure reduces the added cost for extreme probability outcomes, the operator remains pricier than traditional bookmakers when the likelihood is nearly 50:50 (where a fair contract price falls between $0.40 and $0.60),” adds Bettormetrics. “Sporttrade’s 2% commission is relatively more manageable, but the current 2-4% spreads prevent it from becoming genuinely competitive in the present market.”

Polymarket: A Possible Solution … Kind Of

Polymarket might offer a remedy for traders concerned about fees, as it plans to implement charges of just $0.0001 per contract, with the only other costs being from spread crossing. For example, a bettor may have to settle on a contract priced at 51 cents instead of waiting for the price to adjust to precisely 50 cents.

However, as Bettormetrics highlights, there are lingering questions regarding the long-term viability of this model, primarily given that Polymarket has stakeholders to satisfy, including the Intercontinental Exchange (NYSE: ICE), which invested $2 billion in the company last year. Moreover, Polymarket has yet to achieve widespread operation across the US market.

“Though investors in Polymarket may be content supporting this growth phase presently, it remains uncertain how sustainable such economic models will be in the long term, especially in light of the anticipated launch of the ‘POLY’ token in 2026,” concludes Bettormetrics.

POLY refers to the speculation surrounding Polymarket potentially launching a proprietary cryptocurrency in the future — a move that some believe would significantly enhance Polymarket’s popularity and the value of that digital asset.