Published on: February 2, 2026, 07:52h.

Updated on: February 2, 2026, 07:52h.

- A New Jersey accountant faces allegations of embezzling funds from two clients.

- State officials claim the accountant used part of the stolen money to finance his sports betting.

The New Jersey Attorney General’s Office has formally charged an accountant with allegations of misappropriating funds from two companies that employed him. Prosecutors assert that a significant portion of the misappropriated money was used to support his sports betting habit.

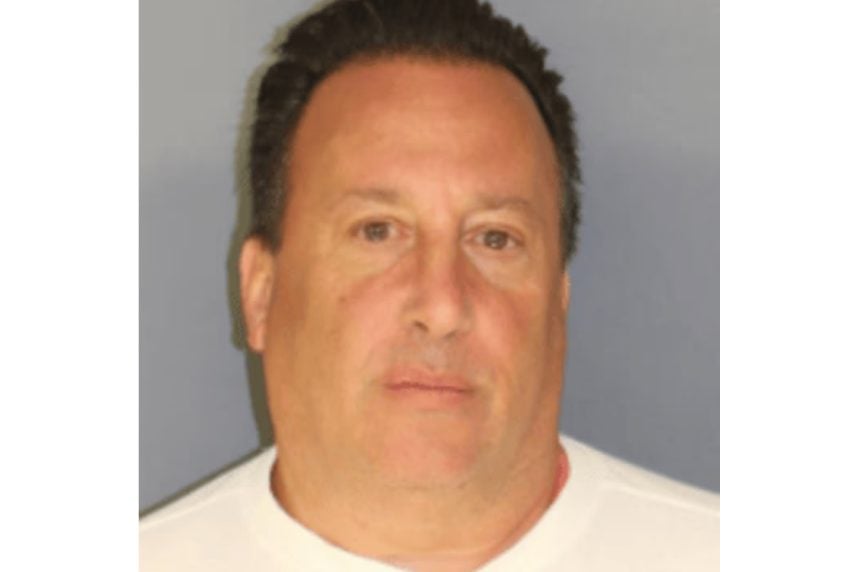

NJ Acting Attorney General Jennifer Davenport, alongside the Division of Criminal Justice, has charged Michael Delia, 61, from West Orange, with two counts of second-degree theft, one count of second-degree money laundering, and another count of second-degree failure to turn over tax collections.

“This defendant is accused of betraying the trust placed in him as an accountant and bookkeeper, fattening his own wallet at the expense of his clients and the people of New Jersey. Such misconduct will be prosecuted firmly,” stated Davenport.

The charges could lead to decades of imprisonment for Delia. Each second-degree felony charge entails a potential sentence of 5 to 10 years in state prison, with fines reaching up to $150,000.

Illicit Sports Betting Activities

Court documents indicate that Delia misappropriated collected tax funds from the two businesses to various personal and corporate bank accounts under his control.

A thorough financial investigation revealed that Delia utilized the embezzled funds for his personal expenses, including credit card payments, mortgage debts, and sports betting activities. From January 2020 to July 2023, prosecutors allege he stole $910,545 in taxes and issued himself checks amounting to $733,313, culminating in a total theft of $1,643,385.

In his dual role as accountant and bookkeeper, Delia was responsible for forwarding taxes collected from the unnamed businesses to the New Jersey Treasury. For the 2023 tax year alone, state authorities claim Delia misappropriated more than $126K in sales taxes for personal use.

The investigation was aided by the US Office of the Inspector General and the Small Business Administration.

Serious Concerns About Sports Gambling Addiction

As detailed by Casino.org in a previous report, experts in mental health, responsible gambling, and educational sectors across America are increasingly worried that the growth of legal sports betting is contributing to a rise in gambling addiction cases.

A study conducted by the University of Massachusetts School of Public Health and Health Sciences found that the incidence of gamblers facing financial difficulties due to gambling nearly doubled between 2022 and 2024.

The American Gaming Association reports that legal sportsbooks accrued over $15 billion from bettors between January and November 2025, marking a 17.4% increase compared to the same period in 2024.

For the upcoming Super Bowl LX, the gambling trade group estimates that regulated sportsbooks will handle $1.76 billion in legal wagers, an increase from the $1.39 billion projection for last year’s event.