Sure! Here’s a reworded version of the provided content, optimized for SEO while retaining the HTML structure:

Published on: August 23, 2025, 08:26h.

Updated on: August 23, 2025, 08:26h.

- Bally’s Atlantic City reports losses for 2025

- Only casino in Atlantic City experiencing financial losses this year

- However, Q3 shows promising results for New Jersey’s casino landscape

The outlook for Bally’s Atlantic City appears uncertain as the Boardwalk casino has disclosed its financial losses for the first half of 2025.

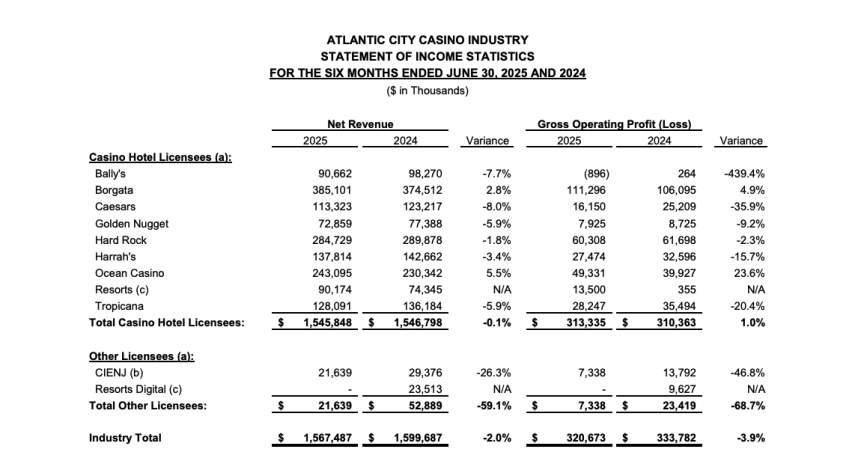

On Friday, the New Jersey Division of Gaming Enforcement (DGE) released second-quarter and half-year results for the nine casinos in Atlantic City. Notably, while all casinos turned a profit from April to June, many saw a decline in profit margins compared to the previous year.

Bally’s reported a profit of merely $2.3 million, indicating a 14.7% decrease from Q2 2024, although this is an improvement from Q1.

Year-to-date, Bally’s is operating at a loss of $896,000 for the first half of the year. Furthermore, its gross operating profit—a key profitability indicator in the Atlantic City gaming sector—has plummeted by 439%.

Gross operating profit calculations exclude factors such as interest, taxes, depreciation, amortization, affiliate fees, and other miscellaneous costs.

Bally’s Challenges Continue

Recent reports from the New Jersey DGE indicate that Bally’s is hosting significantly fewer guests and earning less revenue per room.

In 2024, Bally’s 1,121 rooms saw an occupancy rate of 62% at an average nightly price of $154. However, during the first six months of 2025, occupancy dipped to just 55% with an average rate of $142.

In the first half of 2025, Bally’s net revenue—including gaming, accommodations, dining, and beverages—totaled $90.6 million, marking a 7.7% decline year-over-year. For perspective, leading competitor Borgata reported net revenue of $385.1 million, while Hard Rock and Ocean generated $284.7 million and $243.1 million, respectively.

With impending competition from the downstate New York gaming scene, Bally’s is in dire need of a turnaround, a risky proposition for the aging facility.

Encouraging Signs Elsewhere

Although Q2 revealed tightening profit margins for many casinos along the shore, Borgata achieved a 16% profit increase, and Ocean Casino witnessed a remarkable 67.9% profit rise. This report reflects the spring season prior to Atlantic City’s notable summer resurgence.

During the summer, gaming revenues skyrocketed, with land-based casinos reporting year-over-year increases throughout May, June, and July.

Even before the summer boost, eight out of the nine casinos reported profits, collectively logging a 1% increase in industry-wide profits compared to the same period last year. These establishments have adopted innovative strategies to manage expenses and enhance profit margins, despite flat revenue during the first half of the year.

All operators achieved profitability, even amidst rising costs for supplies and services,” commented James Plousis, chairman of the New Jersey Casino Control Commission.

Plousis noted that the Q2 profit of $179.9 million marks the second-highest profit for a second quarter in four years.

“The quarterly results from the spring, along with last week’s robust July figures, indicate that Atlantic City is effectively attracting regional gaming and tourist interests. Casino hotels have set higher expectations for visitor experiences, having invested over $1.1 billion in the last four years to enhance first-class gaming, dining, and entertainment offerings,” Plousis elaborated.