Published on: December 5, 2025, 02:06h.

Updated on: December 5, 2025, 02:21h.

- Bet365’s investment in sports betting promotions is rising sharply while competitors are scaling back

- Company’s promotional budget as a portion of GGR is the highest in the United States

- The operator is focused on increasing its share of the market in this country

As competitors tighten their budgets for online sports betting promotions, Bet365 is taking a different route by significantly increasing its spending to boost market share in the United States.

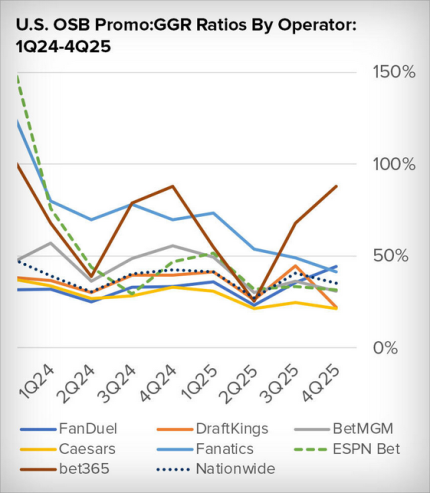

A recent analysis by Eilers & Krejcik Gaming (EKG) reveals that promotional spending among US online sportsbook operators, including leaders like FanDuel and DraftKings, has remained stagnant or decreased since early 2024. In contrast, Bet365 from the UK is ramping up its promotional budget in a concerted effort to gain market share.

The chart above indicates that Bet365’s promotional spending for the three months ending in October neared 85% of its gross gaming revenue (GGR), a figure that stands out as the highest among US sportsbook operators.

Bet365’s Spending Extends to Missouri

This week, Missouri officially became the 39th state to launch legal sports betting, and it seems that Bet365’s spending strategy is also being implemented in this Midwest state.

“Initial search data from Missouri indicates that Bet365 is nearly on par with FanDuel and DraftKings in search interest on the first day of the market launch on December 1st,” EKG notes.

Promotional spending is often viewed as a critical factor in regulated sports betting, as operators must allocate funds to both attract and retain customers. Yet, this strategy can undermine profitability. Over recent years, many operators have reduced their spending on customer incentives due to investor pressure for a stronger focus on profitability.

On this note, Bet365 enjoys the advantage of being a privately held company. The primary shareholder is CEO Denise Coates and her family. Therefore, if the operator chooses to invest heavily to capture customers in the US, it doesn’t need to account for those expenditures to investors.

Reasons Behind Bet365’s Large Investments in the US

Bet365 has not publicly addressed its motives for outspending competitors in the US, but the underlying reason may simply be to attract and retain customers.

There are potential additional motives at play. Earlier this year, speculation arose that Bet365 is collaborating with investment bankers to explore various options that could value the gaming firm at up to $12 billion. Rumors suggest these options might involve a US initial public offering (IPO) or a full or partial acquisition by a US-based private equity firm.

If either of these scenarios unfolds, Bet365 would likely be more appealing to domestic buyers and US investors if it can demonstrate an upward trend in its market share within the country. However, it has been over six months since any discussions of a potential transaction have been reported.