Published on: October 3, 2024, 04:28h.

Last updated on: October 3, 2024, 04:28h.

By examining the data on mobile app downloads, BetMGM is seeing advancements in expanding its online casino presence to a wider audience of bettors.

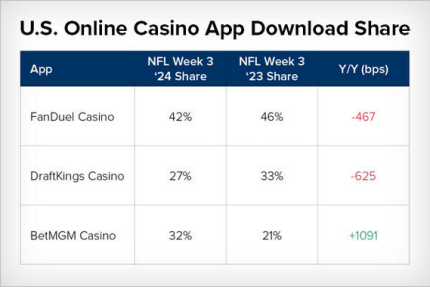

As per Sensor Tower statistics, Eilers & Krejcik Gaming (EKG) observed a surge in the downloads of BetMGM’s casino app during the initial three weeks of the 2024 NFL season, compared to the same period last year, while the downloads of similar platforms from competitors DraftKings and FanDuel lowered.

These advancements are significant for BetMGM as online casino is considered one of the operator’s core strengths, although it had lost some market share in that sector in recent years. Online casinos are seen as a lucrative growth opportunity for gaming companies, with better profit margins compared to online sports betting.

BetMGM iGaming Investments Paying Off

BetMGM, a joint venture between MGM Resorts International (NYSE: MGM) and Entain Plc (OTC: GMVHY), is making notable progress in iGaming, especially after labeling 2024 as a “year of investment,” indicating a stronger focus on online casino.

Throughout the first month of the NFL season, similar trends have been observed, suggesting BetMGM’s significant investment to gain share in online casino GGR this fall,” stated EKG. “BetMGM casino app downloads have increased by an impressive +74% year-over-year, while FanDuel Casino and DraftKings Casino downloads saw growth rates of +24% and +25%, respectively.”

The research firm highlighted that prior to BetMGM’s renewed focus on iGaming, its share of the domestic online casino market had dropped to 20%, ranking third in the second quarter. This decline likely prompted a renewed emphasis on the operator’s online casino offering.

“However, in the period from August 8 to September 23, BetMGM Casino claimed a 32% share of downloads in this category, up from 25% last year,” as per EKG.

Why iGaming Matters to BetMGM

iGaming’s long-term growth potential is critical for operators like BetMGM. Currently, only seven states — Connecticut, Delaware, Michigan, New Jersey, Pennsylvania, Rhode Island, and West Virginia – allow this form of betting, but the number is expected to increase in the future as states seek new revenue streams.

In the case of BetMGM, iGaming could be a differentiating factor that helps the company stand out from its competitors, something it has struggled to do in the online sports betting arena where DraftKings and FanDuel dominate.

“Online sports betting is a highly competitive space where BetMGM has not excelled. Casino has always been BetMGM’s strong suit — our app testers consistently rate BetMGM Casino highly for its content depth and features — so a shift towards casino, during BetMGM’s reinvestment year, makes sense,” concluded EKG.

MGM has also acquired additional assets aimed at strengthening its iGaming presence, with indications that these moves could yield dividends in the long run.