Published on: September 16, 2025, 08:02h.

Updated on: September 16, 2025, 08:02h.

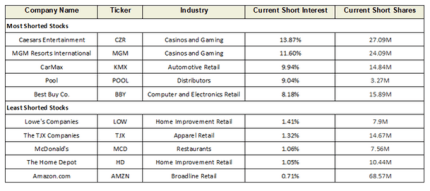

- Caesars and MGM are prime targets for short sellers in August

- Overall bearish bets against casino stocks decreased last month

In August, short sellers focused heavily on Caesars Entertainment (NASDAQ: CZR) and MGM Resorts International (NYSE: MGM), making these two casino stocks the most shorted within the consumer discretionary sector.

Both companies ranked in the top 10 of the most shorted stocks within the S&P 500 during August, a distinction Caesars will soon lose. S&P Dow Jones Indices announced earlier this month that Caesars will be removed from the benchmark index before the markets open on September 22.

By the end of August, short sellers had bet against 27.09 million shares of Caesars, which constitutes 13.87% of the company’s floating shares. In the case of MGM, 24.09 million shares, or 11.60% of the float, were borrowed by short sellers.

This makes them the top picks for short-selling within the consumer cyclical sector last month. Notably, no other gaming companies made it into the top five most shorted consumer discretionary stocks, nor did any casino equities appear in the bottom five least shorted consumer cyclical stocks as of August 31.

Caesars Attracts Short Sellers Consistently

Caesars frequently ranks among the top shorted stocks in the S&P 500, along with other casino equities that seem to attract bearish traders for various reasons this year.

This year, factors such as fluctuating U.S. trade policies culminating in the Liberation Day market drop led traders to place bets against Caesars, MGM, and Wynn Resorts (NASDAQ: WYNN). Recently, continuous reports of declining visitor numbers to the Las Vegas Strip and negative second-quarter earnings outcomes have supported these bearish trends.

Despite a rough July for both Caesars and MGM, the short selling against these casino stocks faced notable rallies last month, particularly for MGM. However, both stocks concluded trading at values similar to their closing prices on August 1.

“Overall bets against the Casinos, Leisure, and Luxury Goods sector have decreased at the end of August in comparison to the end of July,” stated Seeking Alpha.

Caesars’ Short Sellers May Face Challenges Ahead

All eyes may be on Caesars tomorrow if the Federal Reserve is anticipated to announce its first interest rate reduction since November. Following an indication by Fed Chair Jerome Powell on August 22 about potential rate cuts, Caesars’ stock surged.

The rationale is straightforward. Caesars carries one of the highest debt loads in the industry, and it is estimated that a 100 basis point reduction in interest rates could lead to a savings of $60 million annually in interest costs. This is a situation that short sellers of Caesars will need to keep an eye on, as any move by President Trump to replace Powell could lead to accelerated rate cuts, benefiting Caesars and other casino stocks significantly.

“Three interest rate cuts are our baseline expectation under a Fed chair appointed by Trump,” commented Andrzej Skiba, head of BlueBay US fixed income at RBC Global Asset Management. “This could be seen as inflationary (transitioning into a recovering economy), supporting arguments for a steeper Treasury curve, though this is likely to be a discussion for the latter part of 2026, not an immediate market influence.”