Published on: December 10, 2025, 02:41h.

Updated on: December 10, 2025, 02:41h.

- Tax revenue from sports betting has increased over fourfold since 2021

- It is nearing $1 billion nationwide

- In New York, sports betting taxes make up almost 1% of the overall tax revenues

Despite facing criticism, online sports betting has significantly contributed to enhancing state tax revenues.

The US Census Bureau’s latest report indicates that state revenues from sports betting taxes have escalated nearly fivefold in the last five years. In Q3 2021, states gathered $190 million from these taxes, and this amount skyrocketed by 382% to $917 million by Q2 2025.

“The sports betting industry is on the rise, and the tax revenues it generates are essential for funding educational institutions, infrastructure, law enforcement, and resources for gambling addiction recovery,” according to the Census Bureau.

As more states legalize sports betting, the cumulative tax revenue continues to swell. In 2021, 30 states along with Washington, DC, permitted this type of wagering. With Missouri’s recent launch on December 1, this total has increased to 39 states.

Increased Taxes = Elevated State Revenue

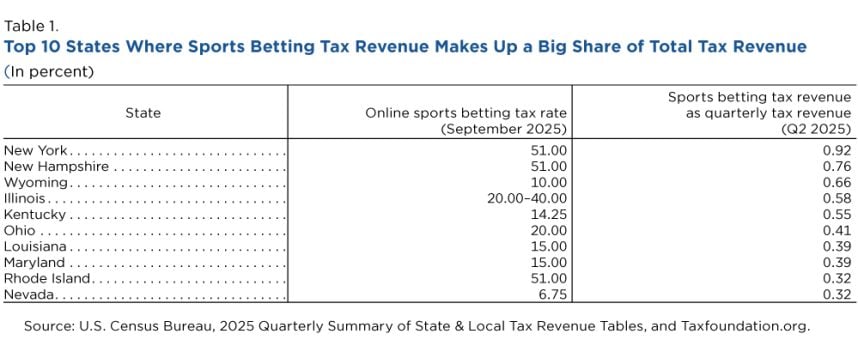

It’s evident that states with higher sports wagering tax rates tend to see a bigger share of overall revenue from this taxation. New York, for instance, holds the title of the largest sports betting market in the U.S., sharing the highest tax rate at 51%.

“Tax rates on sportsbook earnings vary widely among states, ranging from 6.75% (Iowa, Nevada) to 51% (New Hampshire, New York, Rhode Island). Typically, states with higher rates see a significant portion of their total tax revenue stem from sports betting,” the Census Bureau states.

The chart provided above indicates that the period examined by the Census Bureau concluded in the second quarter. Consequently, the 0.58% of total tax revenue attributed to sports betting in Illinois might have risen recently. This is due to Governor J.B. Pritzker approving a policy in July that imposes a tax of 25 cents on the first $20 million in bets placed by an operator, increasing to 50 cents thereafter.

States like Louisiana, Maryland, New Jersey, and Washington, DC, have also raised their sports betting taxes this year. Similar to Illinois, Maryland implemented its tax increase on July 1, which likely means that its contribution to total revenue is now higher as well.

Seasonal Trends Influence Revenue

The seasonal variations affecting sportsbook operators also play a role in state tax collections.

“Typically, sports betting revenues peak during the winter months, specifically in the fourth quarter of one year and the first quarter of the next, compared to the summer period,” notes the Census Bureau. “The year’s first quarter includes major events like the NFL playoffs, Super Bowl, and March Madness college basketball tournament.”

In contrast, revenue tends to decline during the summer when baseball is the sole focal point among the four primary North American sports leagues.