Published on: October 13, 2025, 01:35h.

Updated on: October 13, 2025, 01:35h.

- Dave Ramsey recommends ultimatums for families dealing with gambling addiction

- Ramsey highlights the troubling rise of sports betting in financial discussions

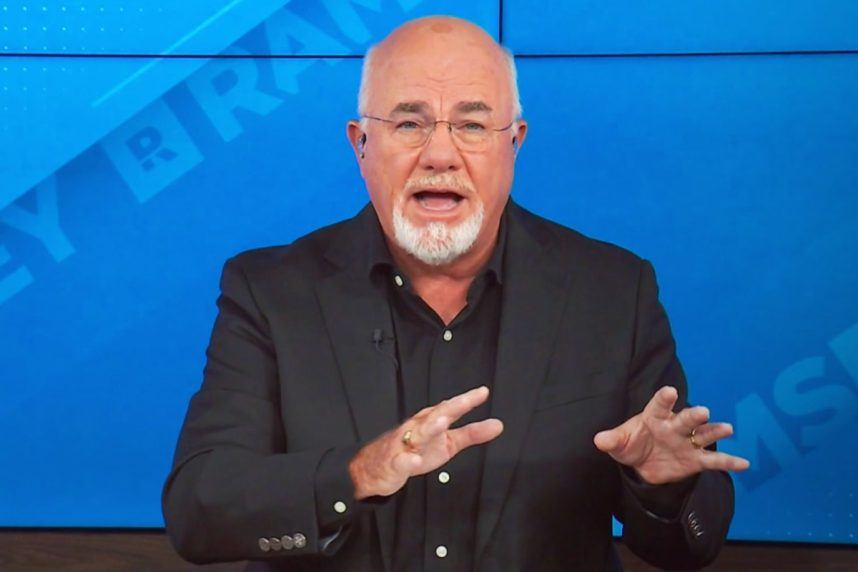

Dave Ramsey, renowned host of a nationally broadcast finance radio show, recently received a call from a distressed 69-year-old woman whose husband has squandered nearly their entire retirement savings on sports betting.

Expressing her emotional turmoil, the caller revealed that her 79-year-old husband had depleted nearly all of their $1 million retirement assets by betting on sports.

Recently realizing their savings were reduced to just $15,000, she started scrutinizing their financial situation after receiving a late tax notice.

For over 30 years, Ramsey has hosted The Ramsey Show, which is among the most popular financial radio programs in the United States, airing daily from 2 pm to 5 pm EST on various platforms including terrestrial radio, podcasts, iHeartRadio, and SiriusXM.

Ultimatums Are Essential for Addicts

According to Ramsey, the woman’s husband, who claims he can control his betting, needs definitive boundaries.

“Seek the help of a marriage counselor along with someone specialized in addiction counseling,” Ramsey advised. “Both professionals can guide you in establishing an ultimatum: no more betting, joining Gamblers Anonymous, and consulting with a therapist.”

Ramsey strongly emphasized that she needs to communicate to her husband that if he gambles again, “I will no longer be in your life.”

Ramsey has consistently cautioned audiences about the dangers of sports betting.

“Sports betting is likely the fastest-growing addictive issue we face in the financial sector,” Ramsey highlighted during a February broadcast. “It’s spiraling out of control, with individuals wagering on just about anything. Many are jeopardizing their futures by betting on the livelihoods of others.”

According to an April report published on Ramsey’s website — Ramsey Solutions — individuals trying to get rich through sports betting apps face low success rates.

“To see any real financial gains long-term, you need a substantial bankroll. Typically, you would have to wager hundreds of thousands each year,” stated finance expert George Kamel of Ramsey Solutions.

“Using bets on major games as a strategy for investment is unwise—despite enthusiasm from avid fans. Savvy investors seeking to accumulate wealth know not to risk their finances on sports betting; instead, they diversify their portfolios and maintain a long-term investment outlook,” Kamel elaborated.

Decline in Problem Gambling Rates

In July, the National Council on Problem Gambling (NCPG) released a comprehensive survey indicating that the surge in hazardous gambling behaviors witnessed during and post-COVID-19 has significantly decreased.

The National Survey on Gambling Attitudes and Experiences discovered that close to 20 million American adults reported experiencing problematic gambling behavior “frequently” over the past year. This marks a reduction from 27.5 million in 2021, though the figure remains higher than in 2018.

Derek Longmeier, president of NCPG, noted, “This new data illustrates that efforts toward responsible gambling and raising public awareness are yielding positive results, but there is still much work to be done. We must continue to leverage this momentum by integrating problem gambling into the overall public health framework and dedicating resources to effective initiatives involving collaboration in prevention, education, treatment, and research with government and community support.”