Published on: December 26, 2025, 06:00h.

Updated on: December 25, 2025, 08:05h.

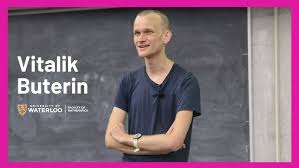

- Co-founder of Ethereum compares risks in prediction markets with those in stock markets.

- He claims that participating in prediction markets is “healthier” than in traditional markets.

- Mentions that prediction markets should be likened to social media platforms.

Vitalik Buterin, co-founder of Ethereum, asserts that trading in prediction markets entails risk levels akin to those seen in equity markets. He advocates for event contract platforms as healthier alternatives for traders.

In a recent social media update, the co-founder of the second-largest cryptocurrency highlighted the potential of prediction markets for objective truth-seeking—a concept long heralded by the industry and its advocates. He emphasized that such markets are less susceptible to the manipulation frequently observed in conventional financial markets.

“I find participation in prediction markets to be healthier than in conventional markets,” Buterin remarked. “A principal reason is that prices are confined between 0 and 1, which minimizes the influence of reflexive effects, ‘greater fool theory,’ pump-and-dump schemes, and more.”

His observations come amidst rising critiques regarding insider trading within prediction markets—an issue that is significantly more challenging to regulate compared to illicit trading practices in traditional finance due to the absence of established guidelines and regulations.

Buterin on Comparable Risks in Prediction and Equity Markets

Buterin argues that the worst-case scenarios in prediction markets include potential incentives for participants to instigate adverse events for profit. However, he notes that this is a theoretical projection. He further suggests that yes/no exchanges exhibit risk profiles similar to those found in equity markets.

“Several negative aspects present in prediction markets are mirrored in traditional stock markets. For instance, if a political actor possesses a ‘CAUSE DISASTER’ button, they might be tempted to press it simply by shorting various stocks that have significantly higher trading volumes than prediction markets,” he stated.

The parallel drawn between traditional investing and prediction markets may intensify concerns among critics who argue that the distinction between investment and gambling is becoming increasingly ambiguous, with prediction markets playing a noteworthy role in this discussion.

In a recent post on platform X, Coinbase Global’s CEO, Brian Armstrong, mentioned that prediction markets can be beneficial tools for Americans to “gain an advantage,” a statement that attracted various reactions mocking the idea that event contracts could improve participants’ financial standing.

Buterin Compares Prediction Markets to Social Media

Buterin posits that prediction markets are pivotal for uncovering truths, and as more traders engage, the resulting evolution will yield probabilities that more accurately reflect the uncertainties surrounding specific events, enhancing truth-seeking abilities. He also views social media as a more pertinent comparison for event contract platforms.

“They should be compared to social media. On social media, numerous individuals proclaim ‘THIS WAR WILL DEFINITELY HAPPEN,’ instilling fear without real accountability. Perceived clout can be accumulated in the moment (which is often monetized) without responsibility afterward,” concludes Buterin.