Published on: January 9, 2026, 08:47h.

Updated on: January 9, 2026, 08:47h.

- Rep. Tom Cole advocates for reinstating the gambling deduction

- The gambling deduction was reduced to 90% in the OBBB

This week, the prospects of restoring the federal gambling deduction for itemized tax filings to its full 100% improved significantly, thanks to support from a key House Republican endorsing the FAIR Bet Act.

The FAIR Bet Act, spearheaded by US Rep. Dina Titus (D-NV), addresses a tax issue created by the Republicans’ One Big Beautiful Bill that reduced the gambling deduction to just 90%. As a result of this change, becoming effective for the 2026 tax year, a gambler winning $100K but also losing $100K would be taxed on $10K of unrealized income.

The FAIR Bet Act has garnered broad support across party lines, showcasing 23 cosponsors: 13 Democrats and 10 Republicans. The latest addition from the GOP holds significant importance.

Backing for the FAIR Bet Act

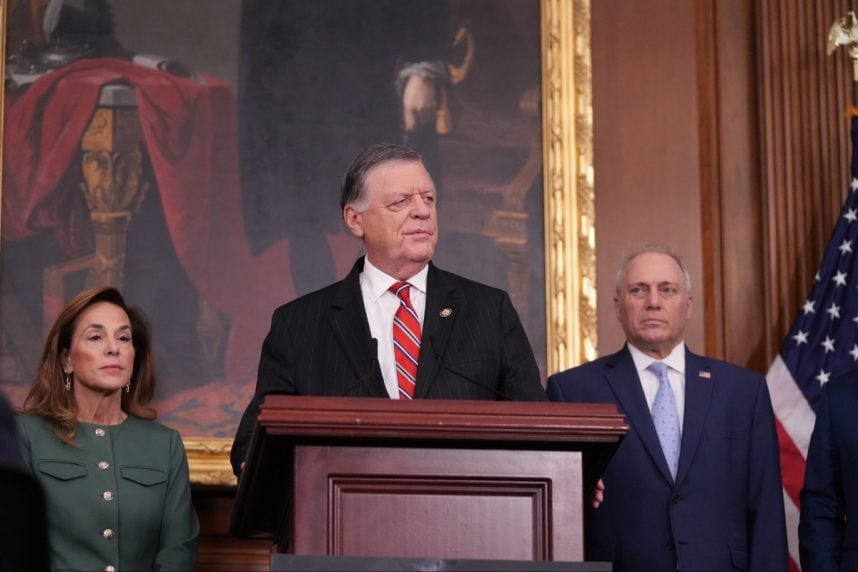

On Thursday, the endorsement came from US Rep. Tom Cole (R-OK). With over 20 years of Congressional experience, Cole heads the House Appropriations Committee, a vital committee that assesses proposals impacting federal allocations.

“Fantastic news for the FAIR Bet Act and the gambling community. The chairman of the House Appropriations Committee has joined me in co-sponsoring legislation that aims to justly amend the tax regulations for players. No one should face taxes on non-existent income. Let’s make this happen,” Titus posted on X.

The FAIR Bet Act is straightforward, consisting of just one page. It proposes replacing “90 percent” with “100 percent” in Section 165(d) of the Internal Revenue Code, as revised by the One Big Beautiful Bill.

Additionally, US Senator Catherine Cortez Masto (D-NV) has introduced a related proposal in the Senate known as the FULL House Act, which stands for Facilitating Useful Loss Limitations to Help Our Unique Service Economy Act.

Historical Context of Gambling Deductions

For many years, gamblers filing itemized federal tax returns could deduct their losses against their winnings, similar to the way businesses deduct their expenses from their income. However, during the Senate Finance Committee’s review of the One Big Beautiful Bill, an amendment reducing the gambling deduction to 90% was introduced.

The Senate Finance Committee is led by Sen. Mike Crapo (R-ID). Supporters of the 90% limit argue that it requires frequent gamblers to disclose a minimum taxable income.

The FAIR Bet Act currently resides within the House Ways and Means Committee. Chairman Jason Smith (R-MO) has shown openness to evaluating the bill, though no hearing date has been set.

“While this change might seem minor, it can have major adverse effects,” stated Titus. “It places an unfair burden on both professional gamblers and recreational players, pushing them towards unregulated offshore markets that lack consumer protections, ultimately undermining efforts towards responsible gaming across the country.”