Published on: December 18, 2025, 11:45h.

Updated on: December 18, 2025, 11:54h.

- Illinois’ per-bet tax is resulting in decreased wagering, yet state revenue is rising

- Research firm indicates other states are unlikely to adopt similar measures

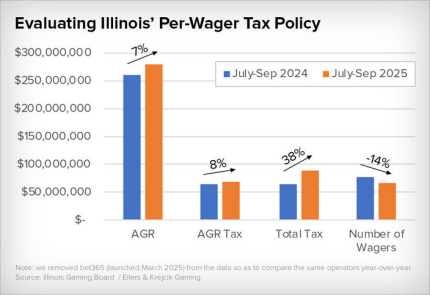

While it’s important to interpret the data cautiously, a research firm highlights that since Illinois enacted its per-bet taxation strategy for online sports betting in July, the total number of wagers has dropped, though adjusted gaming revenue (AGR) has experienced growth.

According to a recent report by Eilers & Krejcik Gaming (EKG), following the tax increase in Illinois that took effect on July 1 and the per-wager fees introduced by major operators DraftKings and FanDuel, the overall number of bets has decreased. However, this has not negatively impacted revenue generation.

Recently, the Sports Betting Alliance (SBA) of Illinois reported that bettors placed five million fewer wagers in September compared to the same month last year, indicating dissatisfaction with the tax and transaction fees. Nevertheless, data from the Illinois Gaming Board (IGB) shows that the tier-one and tier-two handle increased compared to the previous year.

Wagering Volume Declines Among Illinois Bettors, But …

It’s evident that bettors in Illinois are scaling back on the number of wagers they place in response to the tax increase, yet revenue remains unaffected as they seem to be placing larger bets.

“This year has seen a noticeable drop in wagers: a result expected from a per-wager tax, which is largely passed onto consumers,” EKG observes. “Interestingly, adjusted gaming revenue (AGR) has still grown in alignment with the national gross gaming revenue (GGR) average (+8%), suggesting that Illinois bettors are not reducing their betting frequency as a response to the fees but are, in fact, increasing their average bet size.”

Within Illinois’ online sports betting tax framework, a tax of 25 cents per bet is imposed on the initial 20 million bets, while this cost escalates to 50 cents for every subsequent wager.

This situation poses particular challenges for major operators DraftKings and FanDuel. In response, both companies have instituted per-bet transaction fees of 50 cents each. Meanwhile, Fanatics charges 25 cents per bet in the state, and other operators are opting for higher minimum bet amounts.

Other States Not Likely to Imitate Illinois, Yet Online Sports Betting Taxes Are Increasing

For now, Illinois seems to find a balance, experiencing a drop in wagers while maintaining stable revenue. However, the recent tax hike could lead bettors to increase their stakes, potentially raising concerns for the future.

“We do not expect other states to emulate Illinois’ approach in the near future. Notably, Illinois has practically motivated bettors to stake higher amounts, which may have adverse effects on responsible gambling,” EKG adds.

Discussions surrounding whether other states would adopt Illinois’ tax framework are ongoing, but it’s clear that the trend for online sports betting taxes is upward. States like Louisiana, Maryland, New Jersey, and Washington, DC, increased their sports wagering taxes in 2025, with several others proposing their own tax hikes.