Published on: September 29, 2025, 04:10h.

Updated on: September 29, 2025, 04:10h.

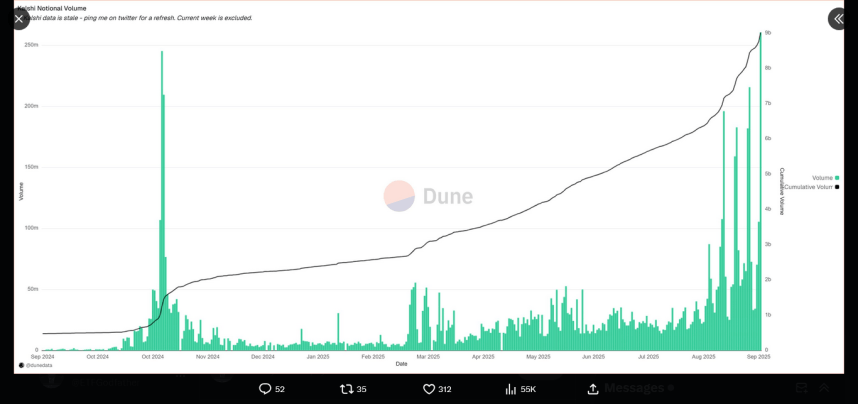

- Kalshi’s trading volume surpassed Election Day records, largely due to NFL contracts

- Robinhood reports it has managed over four billion event contracts, with more than half completed in the current quarter

Traditionally, the football season serves as a significant boost for sportsbook operators, and this year, that trend is prominently reflected in prediction markets.

On Sunday, Kalshi recorded a staggering $260 million in volume across 763,000 event contracts. Tarek Mansour, CEO and co-founder, confirmed on social media that it was a historic day for the yes/no exchange, signifying the relevance of football as the leading sport for betting in the U.S.

“Last night, Kalshi’s daily volume officially exceeded that of Election Day,” stated Mansour. “Nothing compares to football in America.”

The success of Kalshi, Polymarket, and other prediction market operators during the football season sends a clear message to traditional sportsbooks. Kalshi and its rivals first gained traction as primary platforms for “investing” in the outcomes of the 2024 presidential election—given that political wagering is not allowed at U.S. sportsbooks—and are now matching or exceeding those volumes during the NFL season’s early weeks. This trend suggests that football-related prediction market volumes will likely rise as more significant matches approach in the schedule.

Robinhood Joins the Success

Shares of Robinhood Markets (NASDAQ: HOOD), which collaborates with Kalshi, surged by 12.27% today, reaching an all-time high due to CEO Vlad Tenev announcing that more than four billion event contracts have been processed, with over half of that completed this quarter.

Less than a week prior, an analyst estimated that Robinhood’s yes/no derivative segment could contribute $200 million or more annually to the company, based on current month-to-date figures. The trading platform is a substantial contributor to Kalshi’s volume, accounting for 25% to 35% of daily turnover in the prediction market.

This season, Robinhood began offering derivatives related to football. Through its partnership with Kalshi, both firms share the fees generated from the purchase of event contracts by Robinhood clients.

Kalshi’s NFL Pricing Improvements Ongoing

One area where prediction markets can gain a competitive edge over sportsbooks is in the pricing of bets on NFL matches. Some evidence indicates progress in this area during the current season, but improvements are not yet consistent.

In a report to clients on Monday, Citizens Equity Research analyst Jordan Bender noted that on Friday, Sept. 26, Kalshi’s pricing for NFL money lines and over/under bets was less favorable when accounting for transaction fees compared to DraftKings and FanDuel. While there are indications that the pricing gap is narrowing, more progress is necessary.

“Despite some narratives suggesting that exchanges offer superior pricing, the current data suggests it’s not true for the average consumer,” Bender explains. “The NFL season should produce some of the most liquid sports markets for Kalshi, apart from special events, as we believe these games attract the highest betting volume in any U.S. league. If the spread starts to narrow, it would indicate an effective model (higher liquidity), suggesting that Kalshi is providing fewer incentives to market makers. We expect the spread to tighten as user adoption and liquidity increase throughout the football season.”