Published on: August 27, 2025, 01:51h.

Updated on: August 27, 2025, 02:01h.

- Rep. Susie Lee from Nevada divested nearly $1 million in Full House Resorts before the stock value dropped significantly

- Her timely decision may have saved her around $300,000

- Her former spouse is the CEO of the gaming firm

In the realm of investment, there is a fine distinction between good timing and exceptional timing. Recently, Rep. Susie Lee (D-NV) showcased impeccable timing with the sale of her Full House Resorts (NASDAQ: FLL) stock.

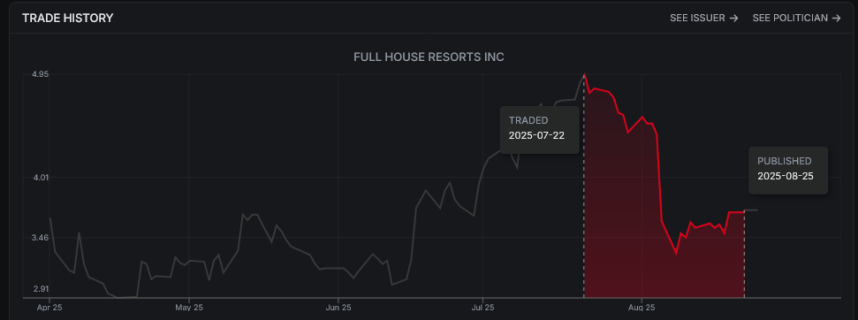

A recent congressional disclosure reveals that Lee, representing part of the casino-heavy Las Vegas Valley, sold between $500,000 and $1 million in Full House stocks on July 22, just over two weeks prior to a significant decrease following a disappointing second-quarter earnings report. The decision may have resulted in a $300,000 savings, according to the Stock Insider application, by selling prior to the stock dropping 25% on August 8.

By decreasing her stakes in the regional casino operator on July 22, Lee capitalized on the stock’s peak prices since late February, managing to escape the financial fallout that followed shortly after. Casino.org attempted to reach Lee’s office for comments; however, there was no response by the time this piece went to press.

Lee’s ex-husband, Dan Lee, is the CEO of Full House Resorts, which raises the possibility that the stock transaction was conducted in his stead. The congresswoman has previously reported stock trades in the gaming sector linked to her ex-spouse, rather than directly attributed to her.

Additional Insights on Lee’s Timing of Full House Transaction

Should it have been Dan Lee selling the Full House shares in July, the transaction’s timing could attract as much scrutiny as if it were directly executed by his ex-wife.

The sale strategically occurred ahead of Full House’s second-quarter earnings announcement, potentially hinting that CEO Lee anticipated a negative investor response. Moreover, this sale took place five weeks after it was revealed he had purchased 276,300 shares of the company’s stock, which led to a significant rally in Full House shares.

Including the transaction on July 22, Rep. Lee’s trading activity in 2025 features nine transactions in Full House, based on Quiver Quantitative data.

This year alone, either Lee has been involved in transactions with seven additional consumer cyclical stocks aside from Full House, encompassing several gaming firms such as Century Casinos (NASDAQ: CNTY), Golden Entertainment (NASDAQ: GDEN), MGM Resorts International (NYSE: MGM), and Wynn Resorts (NASDAQ: WYNN).

Controversial Trades by Rep. Lee

While the trades in gaming stocks listed may have been conducted on behalf of her ex-husband, Lee’s transactions outside the gaming sector have raised concerns.

The Democratic congresswoman drew attention on social media following her May 2024 acquisition of Rhinemetall (OTC: RNMBY), a relatively obscure German industrial company recently trading in the US. Since her disclosed purchase, that stock has surged over threefold.

As a member of the Subcommittee on Military Construction, Veterans Affairs, and Related Agencies, speculation has arisen that she had prior knowledge before the public of Germany increasing its defense budget. Though not widely speculated among U.S. politicians, Lee owns shares in Rhinemetall alongside Rep. Gil Cisneros (D-CA), a member of the House Armed Services Committee.