Published on: December 8, 2025, 11:48h.

Updated on: December 8, 2025, 12:12h.

- Monarch Casino & Resort often finds itself amidst M&A speculations but has yet to finalize a deal.

- The company exhibits a careful approach when assessing potential acquisitions.

- A purchase in Nevada appears improbable for the operator.

Monarch Casino & Resort (NASDAQ: MCRI) is frequently mentioned in discussions surrounding industry mergers and acquisitions, yet it has not expanded beyond its current portfolio of two properties.

However, the situation might be on the verge of change. After recent discussions with management at the Reno-based firm, Truist Securities analyst Barry Jonas indicated that Monarch is still exploring prospective acquisition avenues.

“Management is actively assessing the M&A landscape, stating that this represents ‘the most favorable opportunity in five years’ for the company,” observes Jonas, who maintains a ‘buy’ rating on the stock with a price target of $120.

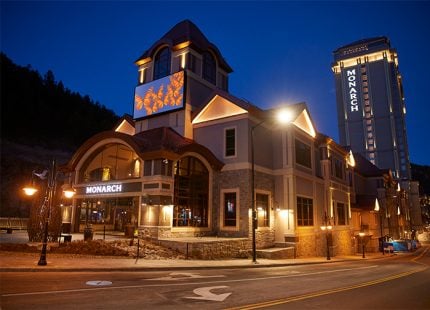

Currently, Monarch’s collection of gaming establishments consists of the Atlantis in Reno and its namesake venue in Black Hawk, Colo. With just these two properties, the company holds the position of the smallest publicly traded casino operator based on the property count.

Monarch Casino’s Discerning Approach to Acquisitions

Despite being frequently linked to industry consolidation tendencies, Monarch Casino is equally known for its rigorous acquisition strategy.

This means that the operator is not interested in making deals merely to grow its portfolio. Such selectivity benefits investors, as not every high-profile gaming acquisition yields positive results for buyers and their shareholders. Some large mergers can be complicated and may take years to show returns for investors.

Monarch has specific criteria that must be met before pursuing a deal. As Jonas highlights, the operator is willing to entertain leverage up to 4x for a transaction but requires that any target possess at least $150 million in EBITDA (earnings before interest, taxes, depreciation, and amortization), alongside the potential for a significant return on investment.

Furthermore, the analyst notes that Monarch is only interested in acquisitions that include real estate, indicating that the company prefers not to incur long-term lease obligations just for the sake of adding another casino.

Geographical Limitations in Monarch’s Acquisition Strategy

In addition to its selective nature, Monarch has certain geographical preferences regarding potential deals. For example, picking up a property in Nevada seems unlikely as it could jeopardize the Atlantis in Reno, while also steering clear of fierce competition in Las Vegas, according to Jonas.

Additionally, Monarch appears firmly against internet casinos, suggesting that it will likely avoid acquisitions in the seven states where online gambling is legal. Another large state with a significant casino market also appears off-limits.

“Illinois presents challenges due to its unstable regulatory landscape,” concludes Jonas. “Nonetheless, the management team emphasizes the possibility of finding unique opportunities in markets with less appealing characteristics. Non-gaming hospitality venues are also being considered as potential targets for M&A activity.”