Published on: February 12, 2026, 10:59 AM.

Updated on: February 12, 2026, 10:59 AM.

- Cathie Wood’s investment firm indicates that prediction markets are not significantly impacting legalized sportsbooks

- Instead, they are taking advantage of “regulatory arbitrage”

- Deposits at DraftKings outstrip those at Kalshi in areas where both platforms operate

Throughout the 2025 NFL season, prediction markets experienced remarkable turnover growth, particularly seeing significant volume increases on Super Bowl Sunday. However, yes/no exchanges are still not capturing a substantial share of the market from regulated sports betting operators.

ARK Investment Management’s analyst Nick Grous recently highlighted that platforms like Kalshi are leveraging their federally regulated status to engage in “regulatory arbitrage.” This means they are providing access to sports betting in states where such activities remain illegal.

“Currently, approximately 30 to 32 states, or about 40% of the U.S. population, lack legalized online sports betting,” notes Grous. “For those residing in these regions, prediction markets represent a straightforward solution: access.”

Grous further indicates that there’s an additional dimension to regulatory arbitrage. While Kalshi clients must be a minimum of 18 years old, most states require bettors to be 21 in regulated settings. This three-year difference likely accounts for a significant portion of the activity observed in legal betting states, leading some critics to argue that prediction markets are exploiting loopholes to target a younger demographic.

Insights at the State Level

Kalshi openly acknowledges its legality across all 50 states and frequently features advertisements promoting sports event contracts in states like California, Florida, Georgia, and Texas. Likewise, new competitors such as DraftKings (NASDAQ: DKNG) and FanDuel emphasize their service availability in these areas.

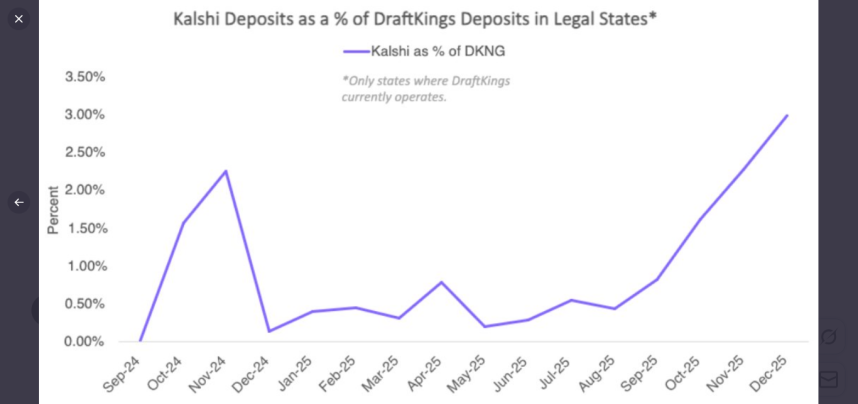

In this context, Grous notes that 60% of Kalshi’s deposits originate from states where online sports betting is not permitted. Essentially, Kalshi is addressing the unmet demand for online sports wagering in those locales. Although Kalshi is witnessing a rise in deposit shares in states with legalized online sports betting, it remains substantially lagging behind DraftKings starting from a very low base.

“In markets where both DraftKings and Kalshi operate, Kalshi’s deposits make up only 3% compared to DraftKings,” Grous emphasizes.

The Future of Prediction Markets

While there are indications of improvement during the Super Bowl, prediction markets have been reported to offer inferior pricing compared to conventional sports betting establishments. However, Grous anticipates continued growth in this sector, driven by greater sports engagement and by catering to unmet demands. He also sees potential growth for event contracts beyond the realm of sports.

Cathie Wood’s ARK holds shares in both DraftKings and Robinhood (NASDAQ: HOOD), one of the leading prediction market enterprises, across various ETFs, and has recently invested in the privately held Kalshi.