Published on: November 17, 2025, 09:25h.

Updated on: November 17, 2025, 10:17h.

- Resorts World New York urges the state to rethink its tax proposal

- Operator may advocate for a reduction in the imposed tax rate

- They could also lobby for increased taxes on competing establishments

After proposing to accept higher taxes if granted one of the three downstate casino licenses, Resorts World New York is now asking state regulators to reevaluate that offer.

According to anonymous sources familiar with the situation, Bloomberg reports that the slots-only venue managed by Genting in Queens is poised to request state regulators to either decrease the taxes levied on their establishment or increase the tax burdens on the other selected downstate casino operators.

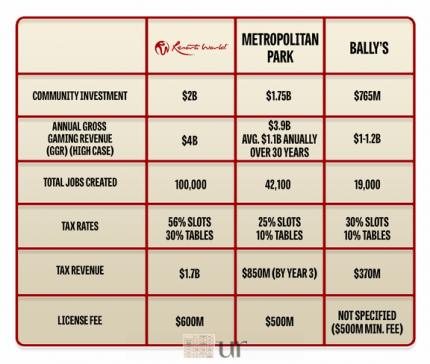

In an effort to attract the attention of New York regulators, Genting recently presented what analysts deemed “ambitious” terms, including a willingness to pay a higher licensing fee alongside elevated taxes. They proposed a $600 million licensing fee, surpassing the $500 million threshold set by the state, along with tax rates of 56% and 30% for slots and table games, respectively—potentially the highest gaming taxes in the United States.

Resorts World Aiming for Upper Hand Over NY Casino Competitors

Last month, MGM Resorts International (NYSE: MGM) shocked the gaming sector by withdrawing from the New York City casino licensing race, leaving only three contenders for the licenses. MGM’s Empire City Casino in Yonkers, similar to Resorts World, was largely expected to secure a permit.

The current hopefuls include Bally’s (Bronx), the $8 billion Metropolitan Park initiative in Queens, and Resorts World New York. Genting has clearly stated its intention to contribute more to the local community and create more job opportunities compared to its rivals, although the reasoning behind their request to revise the tax proposal remains unclear.

Genting estimates that if Resorts World New York operates as a Las Vegas-style casino, it could generate $18.8 billion in tax contributions during its first decade, with projected gross gaming revenue (GGR) nearing $4 billion annually—potentially quadrupling what is anticipated from the Metropolitan Park, which is set to be run by Hard Rock International.

Additional Commitments from Resorts World

Beyond the controversial tax situation, Resorts World New York has made several substantial fiscal commitments, including an investment pledge of $5.5 billion for the venue’s transformation. This sum excludes an additional $2 billion earmarked for community benefits.

A recent forecast disclosed that the Queens casino could contribute $2.5 billion to New York’s Mass Transit Authority (MTA) over a four-year period, far exceeding the $1.8 billion the MTA had anticipated from the new downstate gaming establishments.

The New York Gaming Facility Location Board is presently reviewing the three submissions and is expected to announce the selected operators by December 1. Speculation exists that the board may not grant all three licenses, as they are not required to do so.