Publication Date: December 22, 2025, 12:10h.

Updated on: December 22, 2025, 12:35h.

- Robinhood has unveiled major developments in prediction markets

- Cathie Wood’s ARK Investment Management draws parallels between prediction markets and conventional financial derivatives

- Wood anticipates that Robinhood is poised for a prediction markets “supercycle”

In light of a recent announcement about an extensive venture into prediction markets, Robinhood Markets (NASDAQ: HOOD) is gearing up for a potential event contracts “supercycle.”

This perspective is supported by ARK Investment Management analyst Varshika Prasanna, who mirrors insights shared by Robinhood CEO Vlad Tenev during the company’s YES/NO event last week. Prasanna notes that Robinhood’s prediction markets are now operational on the Legend platform, tailored for their active trader clientele. A rise in adoption by these frequent traders may open avenues for more extensive applications of yes/no derivatives.

“Our analysis indicates that prediction markets are evolving into robust retail investment tools that provide direct exposure to tangible outcomes, akin to derivatives and futures in institutional finance,” highlights Prasanna. “As suggested by Robinhood CEO Vlad Tenev, we are witnessing the early stages of a prediction markets supercycle. With interfaces that are more user-friendly compared to conventional derivatives, prediction markets may be on the brink of widespread acceptance.”

Cathie Wood’s ARK Investment Management is a significant shareholder in Robinhood and also invests in the prediction markets leader Kalshi. Notably, two ARK exchange-traded funds (ETFs) rank among the top eight portfolios that have substantial allocations to Robinhood stocks.

Robinhood’s Prowess in Prediction Markets

Prediction markets are quickly becoming Robinhood’s most rapidly expanding business segment, with ARK’s Prasanna indicating that this sector is projected to generate $300 million in annual recurring revenue for the fintech company by year’s end.

This surge has led some analysts to propose that Robinhood’s entry into the prediction markets arena may pose a competitive challenge to established sportsbooks like DraftKings and FanDuel — both of which are newly entering this market. Additionally, Robinhood is disrupting the traditional event contracts industry.

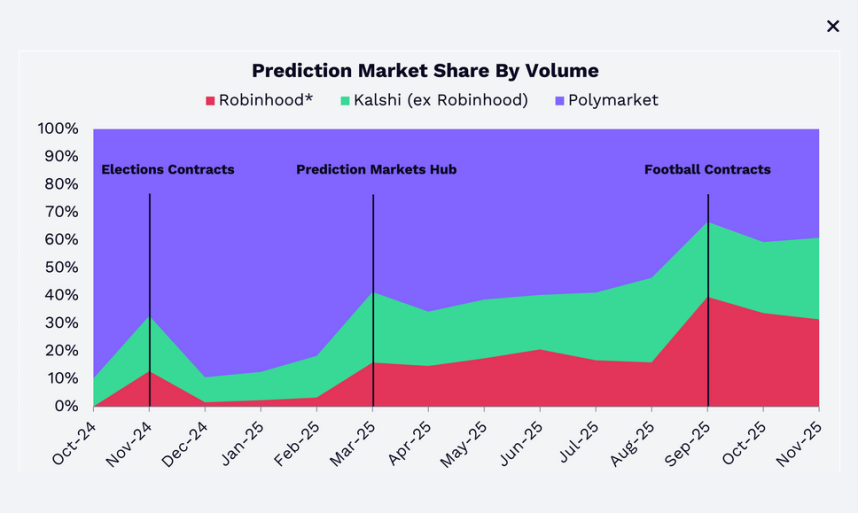

“Furthermore, through its collaboration with Kalshi, Robinhood has captured a substantial share from its main competitor, Polymarket,” claims Prasanna.

Predictions Markets as Agents of Change

The surge in trading volume on platforms like Kalshi this year has largely been driven by contracts tied to sports events. Robinhood has embraced this trend, emphasizing its football “combos,” a term used to describe prediction market parlays.

Experts predict that additional sectors, including cryptocurrency valuations, cultural events, economic forecasts, and political trends, will be crucial for the growth of prediction markets, with a focus on reducing reliance on sports-related event contracts.

“While they will encompass various categories, prediction contracts are likely to exert significant influence on financial, economic, and political markets, providing real-time signals that reflect the probabilities surrounding consensus beliefs,” concludes ARK’s Prasanna.