Date Published: January 22, 2026, 11:26h.

Last Updated: January 22, 2026, 12:41h.

- Analyst upgrades Sphere Entertainment rating from “neutral” to “buy.”

- Identifies multiple factors contributing to a positive outlook.

- Predicts enhanced profitability for 2026 and 2027.

On Thursday, shares of Sphere Entertainment (NYSE: SPHR) experienced a notable increase following a research firm’s decision to elevate the stock’s rating from “hold” to “buy.”

In a recent report, BTIG announced the upgrade alongside a projected price target of $110 for Sphere stock, suggesting an 18.1% increase from the close on January 21. Following BTIG’s optimistic outlook, shares rose nearly 6.5% during midday trading, marking a remarkable 138.7% increase over the past year.

“While we have consistently highlighted the enhancement of fundamentals, profitability, and overall narrative, we underestimated the execution capabilities amid a challenging lower-end consumer environment and the resulting potential for reevaluation,” stated BTIG in their report.

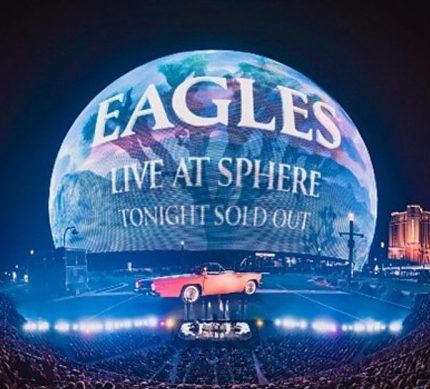

The research firm further emphasized that Sphere presents a “catalyst-rich event path” as consumers increasingly seek immersive live entertainment experiences.

Potential Catalysts for Sphere Stock Growth

One of the key factors identified by BTIG analyst Tyler DiMatteo is Sphere’s expansion strategy, which includes plans to develop a “mini Sphere” near MGM National Harbor in Maryland.

This new venue is slated to accommodate 6,000 seats, significantly fewer than the 20,000 at Sphere’s flagship location in Las Vegas. However, DiMatteo believes this Maryland location could enhance profit margins, generating an estimated $30 million to $50 million in annual revenue. The Maryland Sphere will be the company’s third venue, following the announcement of a similar project in Abu Dhabi in 2024.

Additionally, BTIG anticipates that Sphere stock will benefit from factors such as new sponsorship opportunities, high-profile concerts, and content licensing arrangements, similar to their deal with “The Wizard of Oz.” Recently, the company announced that the partnership with “The Wizard of Oz” has significantly boosted revenues for the Las Vegas Sphere.

“The Wizard of Oz at Sphere, which launched in Las Vegas on August 28, has sold over 2 million tickets and generated more than $260 million in ticket sales as of January 19,” the company stated.

Improved Profitability May Drive Sphere Stock Higher

Throughout Sphere’s public market history, there have been moments when analysts labeled its stock as undervalued. There’s potential for these valuation disparities to diminish as the entertainment company enhances its profitability.

This scenario aligns with BTIG’s forecast, which expects Sphere’s profitability to rise this year and in 2027, driven by international expansion and gains from content licensing.

A total of eleven sell-side analysts follow Sphere stock, with eight assigning a rating equivalent to “buy” or “strong buy.” The average price target among them sits at $104.45.