[ad_1]

To bring you the most in-depth knowledge possible, we continue our Asia-Pacific Expert Insight series with this article. Gaming industry insiders on the ground in this region will share their professional deconstruction of important trends in the casino sector in Macau, Japan, the Philippines, and throughout the area.

The COVID-19 coronavirus outbreak has spurred serious revenue downturn in Asia’s gaming sector. In response, casino stocks in Macau and the Asia-Pacific region took a brutal beating all week.

Plummeting casino stocks in Macau and beyond this past week mean gaming operators will have to implement more aggressive and creative marketing strategies to recover. (Image: economictimes.indiatimes.com)

Although Macau’s casinos reopened after a two-week government mandated closure, restrictions on travel to the area still remain in full force. And other countries in the region are also exercising their right to prohibit Chinese tourists from entering their borders.

Clearly, it will take more than just a single quarter for China-facing casinos in Asia to get back on their feet, and the long-term outlook for the Chinese economy is far from encouraging.

Gaming operators will have to zero in on enhanced ways to draw in and keep players coming back, using specific and very targeted methods to do so.

Going to the Head of the CLASS

In the hospitality industry — which of course includes casinos and integrated resorts — how customers experience their stay and play often hinges on the engagement levels and behavior of employees, which in turn is a critical component of players’ experiences.

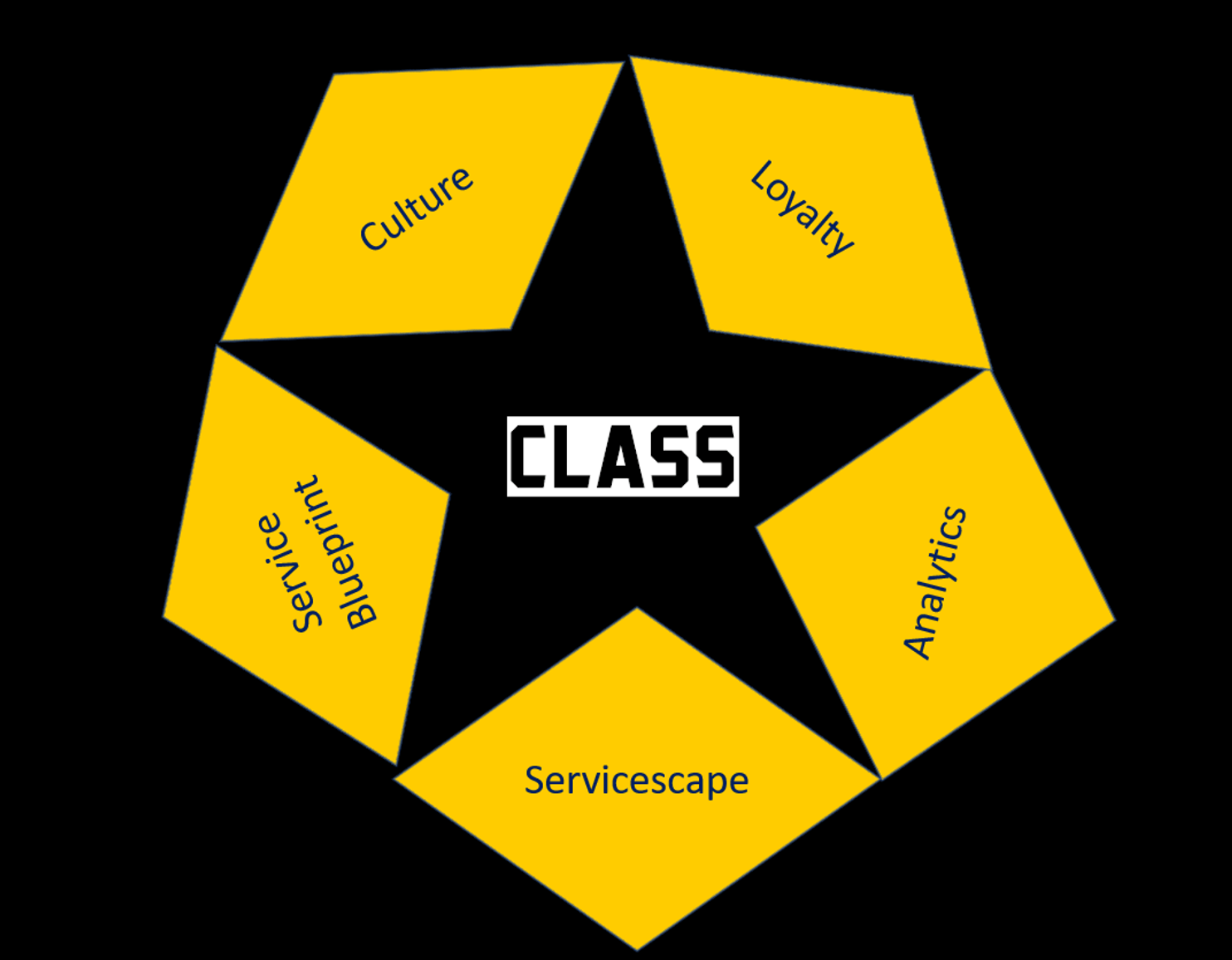

The CLASS framework is an acronym for five key components casinos may be able to implement to rev up customers’ excitement about returning to and playing in Macau’s gaming venues. It’s particularly relevant in Asian gaming markets, where several jurisdictions could be vying for the same customer.

Using the CLASS paradigm may help jump-start Macau casinos’ bottom line in the aftermath of coronavirus and a stock freefall. (Image: Courtesy Sudhir Kale)

Culture should be employee-centric, as well as customer-centric. Gaming operators could borrow from the playbooks of other industries — such as Zappos, Southwest Airlines, Nordstrom, and Enterprise Rent-A-Car — which have demonstrated strong bottom lines by looking out for their employees internally and extending that to ensuring that guests have a much better time.

Building Loyalty

Most casino loyalty programs are built on the “earn-and-burn” concept — where gamblers get rewarded after a certain amount of money has been played. But in the wake of the coronavirus casino shutdowns and the need to do everything possible to spur play and keep customers in their seats, there will have to be a shift in business-as-usual if gaming operators hope to have good earnings reports at the end of 2020.

Attitudinal loyalty — where players stay because they truly love the casino and what it represents to them — will be best achieved by offering customers rewards that are specifically suited to their activities and interests, and most importantly, something they themselves cannot — or will not — buy.

By offering something unique that competitors don’t, and by responding to their interests and what brings them back, gaming operators can create longer-term brand loyalty from their players, which is paramount to the recovery process.

Give ‘Em What They Want

The player is always right, to paraphrase the old marketing adage. Anything gaming operators can do to get inside their customers’ minds will benefit casinos in the long run. Recent advances in analytics have made gathering and applying such customer data much simpler. More Macau casinos will need to ramp up (or create) their own Voice of the Customer (VoC) program, in which players can give direct and immediate feedback when it comes to how they feel about any particular casino.

Without understanding the various VoC segments from an integrated resort’s gaming — as well as non-gaming — offerings, operators could miss out on key opportunities to expand their player base and ensure repeat business.

Player analytics need to be supplemented with controlled experimentation, of course. Experiments help operators identify which promotions work best and for which customer segments.

Don’t Curb Your Appeal

Key to pulling players back in will be making sure any given casino’s servicescape is top-notch and designed with player demographics in mind.

Servicescape refers to an integrated resort’s exterior — from landscape and the casino’s exterior design all the way down to signage, parking, and of course, the surrounding environment. It also encompasses the playing floor’s interior design and decor, slot equipment, casino signage and the overall layout.

Also important to players are things like air quality, the casino’s temperature, and lighting. Macau’s gaming operators shouldn’t underestimate the impact of the physical environment when it comes to influencing behaviors and creating an overall environment that speaks to customers, which is particularly important for integrated resorts (IR).

How long Macau casino customers stay in a particular gaming area, their spend and level of enjoyment, for instance, are determined by several factors such as room temperature, ambient smells, music, décor, and lighting.

For up-and-coming projects — such as integrated casino resorts to which $65 billion have already been committed and that are slated to open between now and 2025 — there’s a need to place particular emphasis on the servicescape to ensure that the ambience of the property is consistent with the conscious as well as unconscious desires of the customer segments they seek to serve.

Service with a Smile

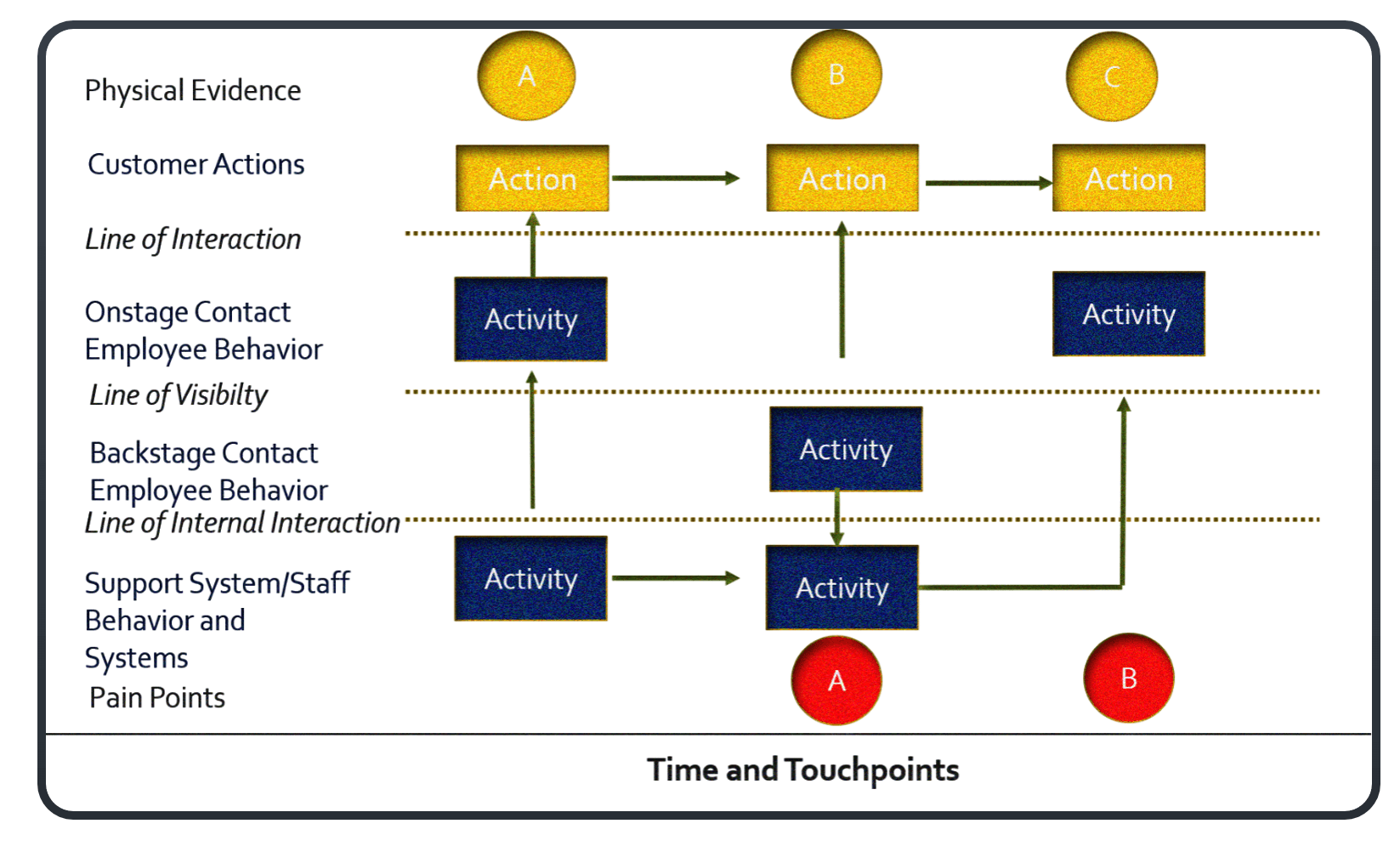

Another key to recovering casino customer loyalty will be doing what’s known as “service blueprinting” — which allows suits to see the gaming floor from their players’ perspectives.

Service blueprinting will be an important key to Macau casinos’ recovery process. (Image: Courtesy Sudhir Kale)

By identifying and mapping out all the major touchpoints experienced by a customer from the first point of contact with the gaming operator all the way through to exiting the resort premises, Macau management will be able to get a better look at what their players truly want.

For each touchpoint, five corresponding components are identified: the customer’s expected behavior, physical evidence taken in by the customer at that touchpoint, the contact employee’s behavior visible to the customer (frontstage behavior), the contact employee’s behavior that the customer does not get to see (backstage behavior), and the support systems and staff required for the customer experience to proceed as planned. (Figure 2 above depicts a condensed service blueprint).

Blueprints are used to address customer’s pain and fix fail points, establish touchpoints of differentiation, and ensure consistency in the delivery of customer experience. When correctly designed and managed, service blueprints have a powerful impact on the customer experience, something that Macau’s gaming operators would do well to remember.

Combined together, the components of CLASS could help to differentiate the Asian gaming enclave’s integrated resorts. This framework is a powerful guide with which casino businesses in the highly competitive Asian markets can re-establish a stronger customer franchise, enhance guest experiences, and critically shore up their bottom line.

Sudhir H. Kalé, Ph.D., is a gaming scholar and leading casino consultant based in Gold Coast, Australia. His firm, GamePlan Consultants, has advised clients on five continents on corporate culture, CRM, servicescape, and service blueprinting. Sudhir has published more than 100 articles on the marketing and management of casinos. You can reach him at: [email protected].

[ad_2]

Source link